For the 24 hours to 23:00 GMT, the AUD rose 0.08% against the USD and closed at 0.7848.

LME Copper prices declined 1.1% or $74.5/MT to $6971.5/MT. Aluminium prices declined 0.2% or $4.5/MT to $2106.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7848, with the AUD trading flat against the USD from yesterday’s close.

Overnight data revealed that Australia’s seasonally adjusted unemployment rate unexpectedly dropped to 5.5% in September, hitting its lowest level since May 2017 and boosting optimism over the health of the nation’s labour market. Markets had expected the nation’s unemployment rate to remain unchanged at 5.6%. Further, the number of people employed in the nation advanced by 19.8K in September, surpassing market expectations for an increase of 15.0K and following a gain of 54.2K in the previous month.

Elsewhere in China, Australia’s largest trading partner, the gross domestic product (GDP) advanced 6.8% on an annual basis in the third quarter of 2017, at par with market consensus and following a rise of 6.9% in the previous quarter.

Further, the nation’s retail sales climbed more-than-expected by 10.3% on an annual basis in September, compared to a rise of 10.1% in the previous month, while markets had anticipated for an increase of 10.2%. Also, the nation’s industrial production rose 6.6% YoY in September, accelerating to a three-month high and beating market expectations for a gain of 6.5%. Industrial production had registered an advance of 6.0% in the prior month.

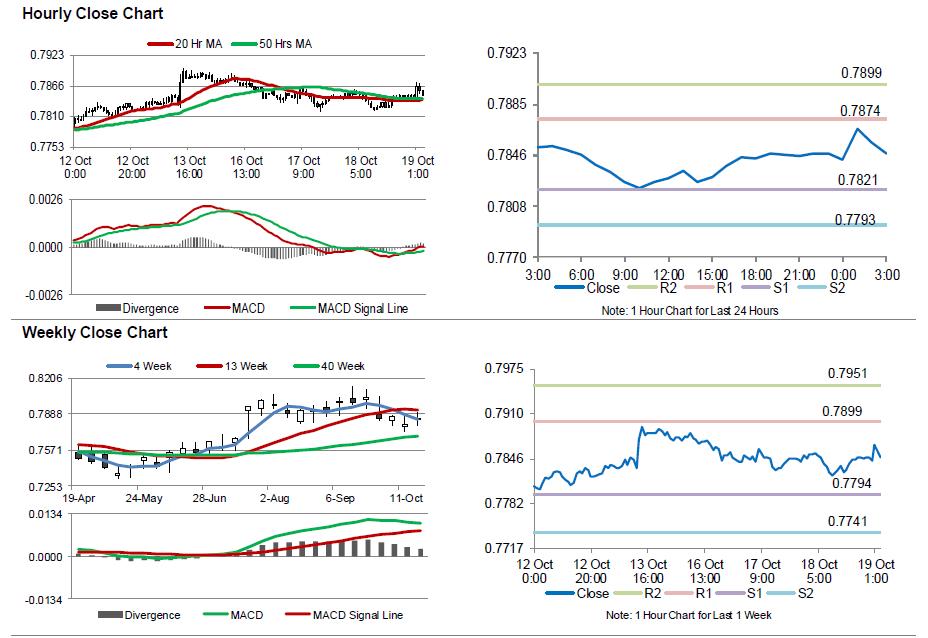

The pair is expected to find support at 0.7821, and a fall through could take it to the next support level of 0.7793. The pair is expected to find its first resistance at 0.7874, and a rise through could take it to the next resistance level of 0.7899.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.