For the 24 hours to 23:00 GMT, the AUD weakened 0.75% against the USD to close at 0.6978.

LME Copper prices rose 1.63% or $86.0/MT to $5366.0/MT. Aluminium prices rose 2.17% or $34.5/MT to $1628.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6993, with the AUD trading 0.22% higher from yesterday’s close.

Early morning data showed that Australian unemployment rate declined to 6.2% in August, at par with market expectations and compared to prior month’s 13-year high of 6.3%. Additionally, the total number of employed people in the nation climbed more than forecasted by 17,400 in August, following a revised increase of 39,200 in July.

On the other hand, consumer inflation expectation in Australia dropped to a level of 3.2% in September, from a reading of 3.7% in the preceding month.

Elsewhere, in China, Australia’s biggest trading partner, consumer price inflation quickened to 2.0% on a YoY basis in August, exceeding market expectations for a gain of 1.8% and prior month’s advance of 1.6%. However, the producer price index slipped more than anticipated to the worst in almost six years dropping by 5.9% on an annual basis in August, compared to a decline of 5.4% in July, thereby exacerbating concerns for policymakers.

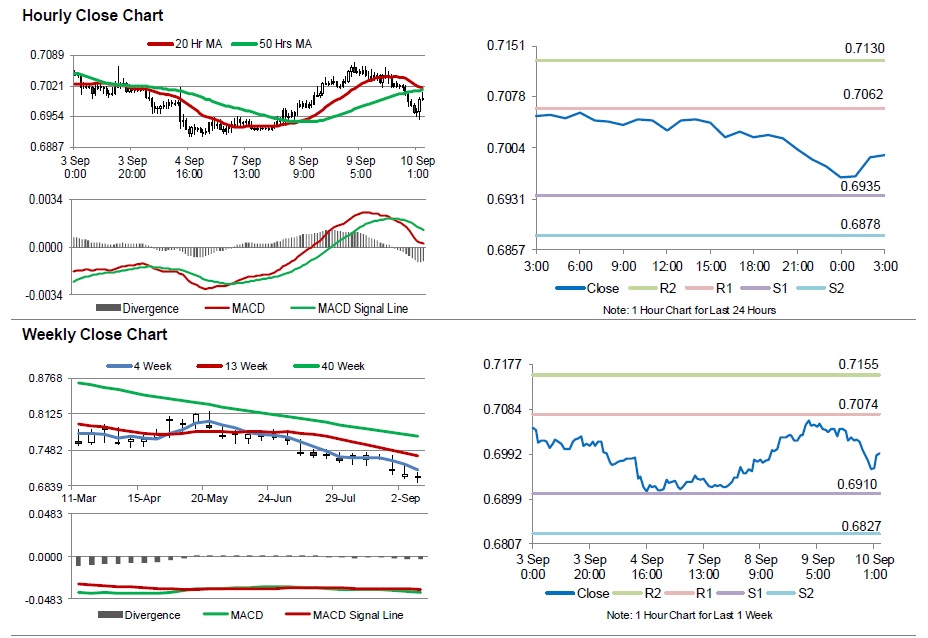

The pair is expected to find support at 0.6935, and a fall through could take it to the next support level of 0.6878. The pair is expected to find its first resistance at 0.7062, and a rise through could take it to the next resistance level of 0.7130.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.