For the 24 hours to 23:00 GMT, the AUD weakened 1.24% against the USD to close at 0.7230.

LME Copper prices declined 0.72% or $33.5/MT to $4600.5/MT. Aluminium prices declined 0.16% or $2.5/MT to $1529.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7212, with the AUD trading 0.25% lower from yesterday’s close.

Early this morning, data showed that, Australia’s unemployment rate unexpectedly held steady at a two-and-a-half-year low level of 5.7% in April, compared to market expectations of an advance to 5.8% On the other hand, the number of people employed rose less-than-expected by 10.8K in April, lower than market expectations of an advance of 12.0K. The number of people employed had recorded a revised increase of 25.7K in the prior month. However, most of the jobs added were in part-time roles increasing by 20.2K positions, signalling weakness in Australia’s labour market. Meanwhile, full-time jobs contracted by 9.3K positions.

Elsewhere, in China, Australia’s largest trading partner, the MNI business sentiment index eased to a level of 50.0 in May, from a reading of 50.5 in the previous month.

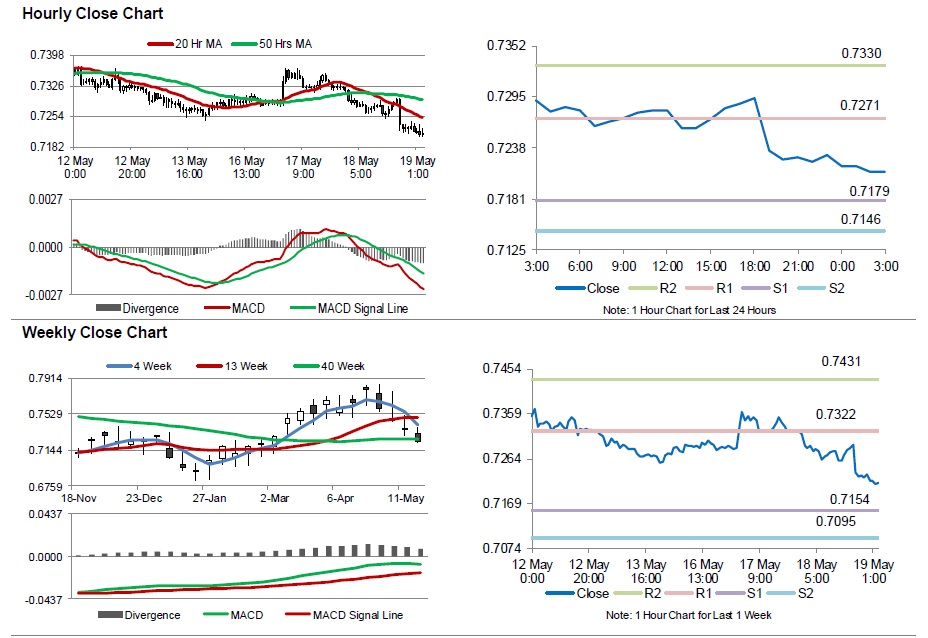

The pair is expected to find support at 0.7179, and a fall through could take it to the next support level of 0.7146. The pair is expected to find its first resistance at 0.7271, and a rise through could take it to the next resistance level of 0.7330.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.