For the 24 hours to 23:00 GMT, the AUD declined 15.89% against the USD and closed at 0.5807.

In the Asian session, at GMT0400, the pair is trading at 0.5569, with the AUD trading 4.10% lower against the USD from yesterday’s close.

Overnight data showed that Australia’s seasonally adjusted unemployment rate unexpectedly dropped to 5.1% in February, compared to market expectations for a steady rate. In the previous month, unemployment rate stood at 5.3%.

The Reserve Bank of Australia (RBA), in its interest rate decision, slashed its key interest rate to 0.25% from 0.50%, to curb the economic impact of the coronavirus outbreak. Further, the central bank stated that it would purchase government bonds in the secondary market and keep the yield on 3-year bonds at around 0.25%. Separately, RBA Governor, Philip Lowe, warned that the economic fallout of the coronavirus could result in recession this year.

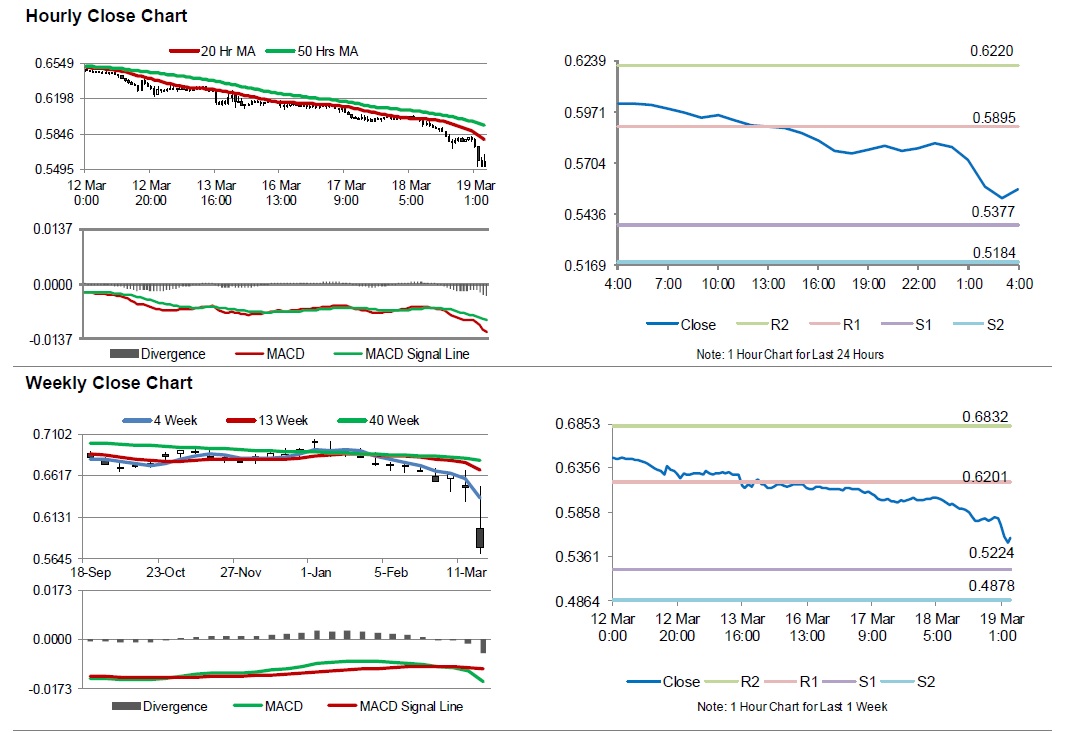

The pair is expected to find support at 0.5377, and a fall through could take it to the next support level of 0.5184. The pair is expected to find its first resistance at 0.5895, and a rise through could take it to the next resistance level of 0.6220.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.