For the 24 hours to 23:00 GMT, the AUD rose 0.82% against the USD and closed at 0.7174.

LME Copper prices declined 0.47% or $21.5/MT to $4562.0/MT. Aluminium prices declined 0.56% or $8.5/MT to $1520.0/MT.

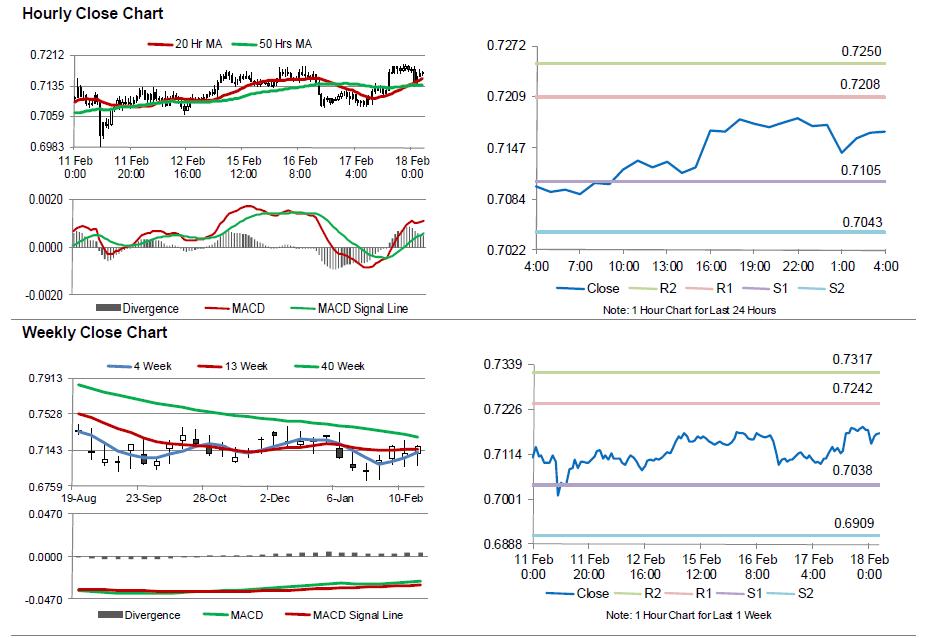

In the Asian session, at GMT0400, the pair is trading at 0.7167, with the AUD trading 0.1% lower from yesterday’s close.

Early this morning, data showed that Australia’s unemployment rate unexpectedly climbed to 6.0% in January, while markets expected it to remain steady at 5.8%. Additionally, the number of people employed unexpectedly fell by 7.9K in January, from a revised fall of 0.8K in the previous month and compared to market expectations for a rise of 13.0K.

Separately, in China, Australia’s largest trading partner, data showed that, the consumer price index rose less-than-expected by 1.8% YoY in January, following a gain of 1.6% in the previous month and compared to market expectations for a rise of 1.9%. However, producer prices fell for the 47th straight month as falling commodity markets and weak demand highlighted that deflationary pressure remains large in the world’s second-largest economy.

The pair is expected to find support at 0.7105, and a fall through could take it to the next support level of 0.7043. The pair is expected to find its first resistance at 0.7208, and a rise through could take it to the next resistance level of 0.725.

The currency pair is trading above its 20 Hr and 50 Hr moving average.