For the 24 hours to 23:00 GMT, the AUD rose 0.59% against the USD and closed at 0.7628.

LME Copper prices declined 0.02% or $1.0/MT to $4671.5/MT. Aluminium prices declined 2.37% or $40.0/MT to $1645.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7660, with the AUD trading 0.42% higher against the USD from yesterday’s close, after minutes of the RBA’s latest monetary policy meeting highlighted that updated forecasts on jobs and inflation will aid any policy decisions in the next board review.

Minutes of the Reserve Bank of Australia’s (RBA) October meeting indicated that although the Australian economy had continued its transition following the end of the mining investment boom, there exists a high degree of uncertainty in the domestic labour and housing markets. Further, policymakers noted that third quarter inflation figures and an update of the forecasts will be an important indication to consider the economic outlook and to review conditions in the labour and housing markets.

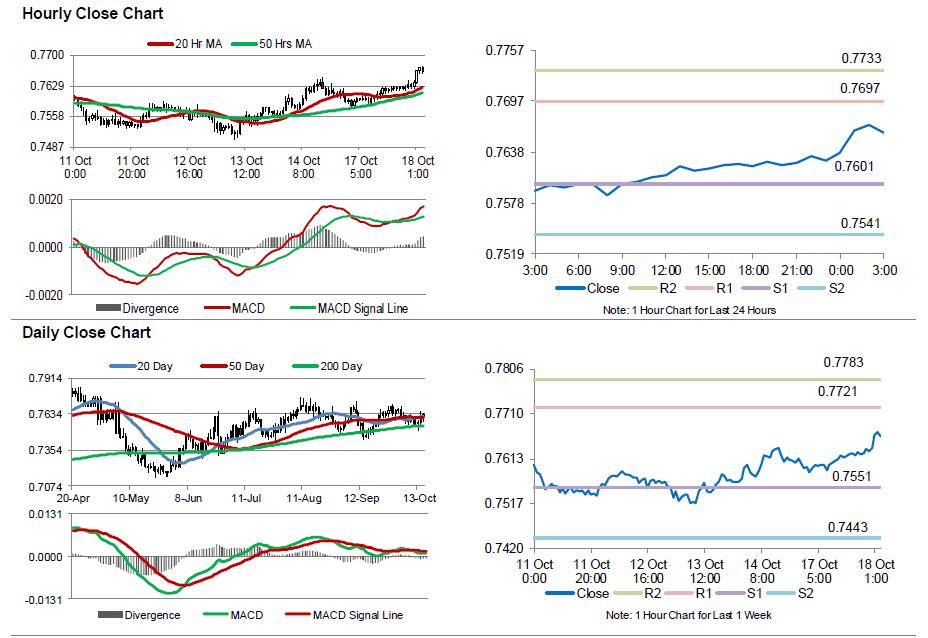

The pair is expected to find support at 0.7601, and a fall through could take it to the next support level of 0.7541. The pair is expected to find its first resistance at 0.7697, and a rise through could take it to the next resistance level of 0.7733.

Going ahead, market participants would await the release of Australia’s Westpac leading index for September, slated to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.