For the 24 hours to 23:00 GMT, AUD strengthened 0.37% against the USD to close at 0.9161.

Yesterday, the Reserve Bank of Australia (RBA) Deputy Governor, Philip Lowe hinted towards the need for a further deprecation in the value of Aussie in order to further stabilise the economy’s growth. However, unlike other RBA officials, Lowe did not comment if the Aussie at current level was “uncomfortably high.”

LME Copper prices rose 0.8% or $49.5/MT to $6559.5/MT. Aluminium prices advanced 1.7% or $28.0/MT to $1716.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.9180, with the AUD trading 0.21% higher from yesterday’s close, after the RBA Governor, Glenn Stevens indicated that the Australian economy is showing strong signs of recovery and there are encouraging evidence that the handover from mining to non-resources industries in the nation’s economy was underway. Furthermore, he revealed that the Australian dollar continues to remain too high at current levels. Moreover, he also predicted a boom in the Australian housing construction market over the next couple of years but at the same time also acknowledged that the current level of borrowing in the nation pose a risk to the property market.

Separately, the RBA, in its Financial Stability Review report, stated that the nation’s financial system is sound and major banks are well placed to meet higher international liquidity standards due to kick in next year. Meanwhile, the report cautioned banks and investors not to chase quick profits from the housing sector.

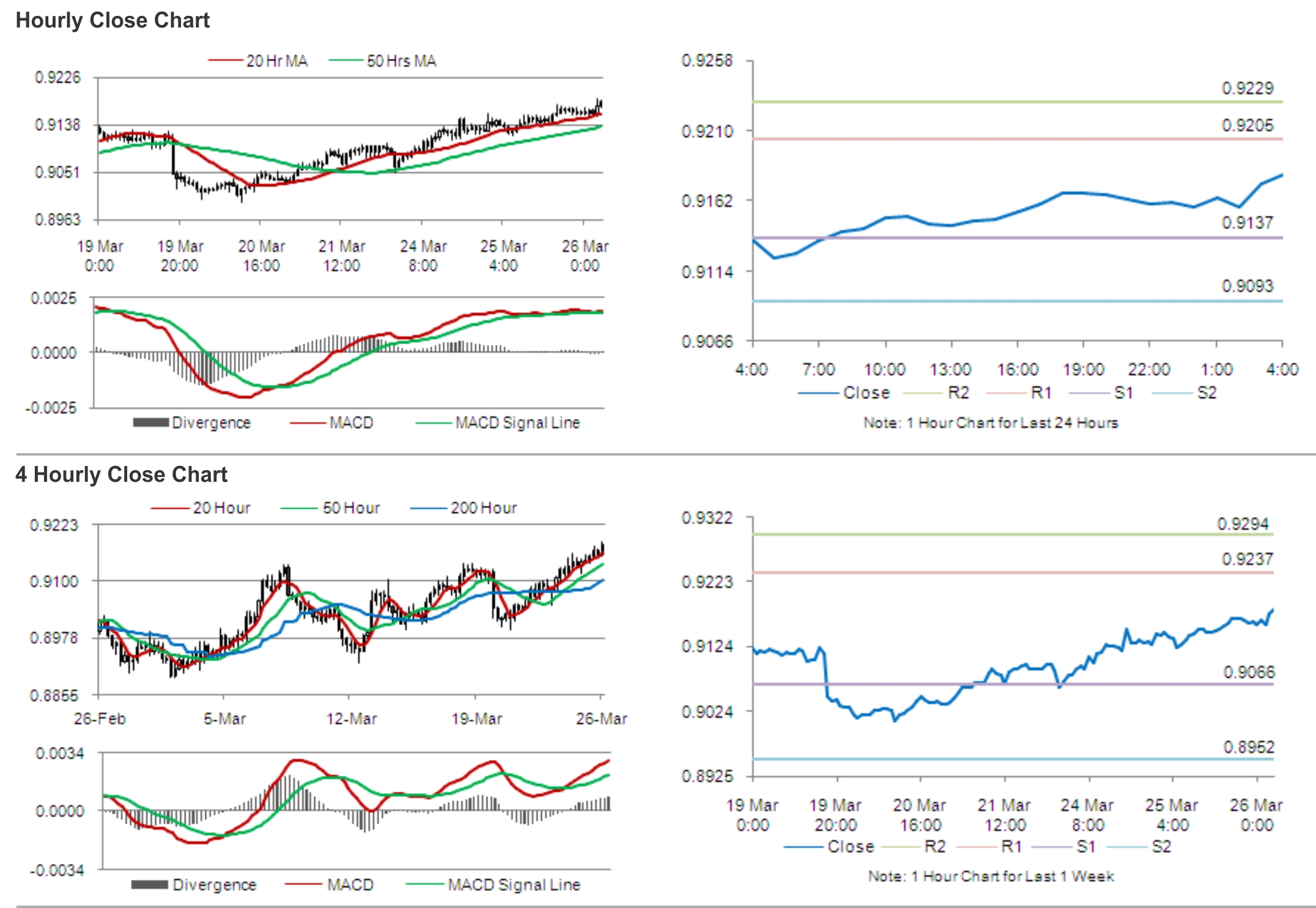

The pair is expected to find support at 0.9137, and a fall through could take it to the next support level of 0.9093. The pair is expected to find its first resistance at 0.9205, and a rise through could take it to the next resistance level of 0.9229.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.