For the 24 hours to 23:00 GMT, the AUD rose 0.35% against the USD and closed at 0.7823.

LME Copper prices rose 1.9% or $128.0/MT to $6813.0/MT. Aluminium prices declined 0.3% or $6.5/MT to $2117.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7837, with the AUD trading 0.18% higher against the USD from yesterday’s close.

Earlier in the session, the Reserve Bank of Australia (RBA), in its twice-yearly Financial Stability Review, expressed deep concerns about the property market and warned that household borrowing is a key risk to the nation’s financial system as it could see households struggle to repay their debt.

Separately, in China, Australia’s largest trading partner, trade surplus narrowed more-than-expected to CNY193.0 billion in September, following a surplus of CNY286.5 billion in the preceding month, while investors had envisaged for a surplus of CNY266.0 billion.

Additionally, the nation’s annual exports increased less-than-anticipated by 9.0% in September, after recording a gain of 6.9% in the previous month. Also, the nation’s imports grew more-than-expected by 19.5% YoY in September, compared to a rise of 14.4% in the prior month.

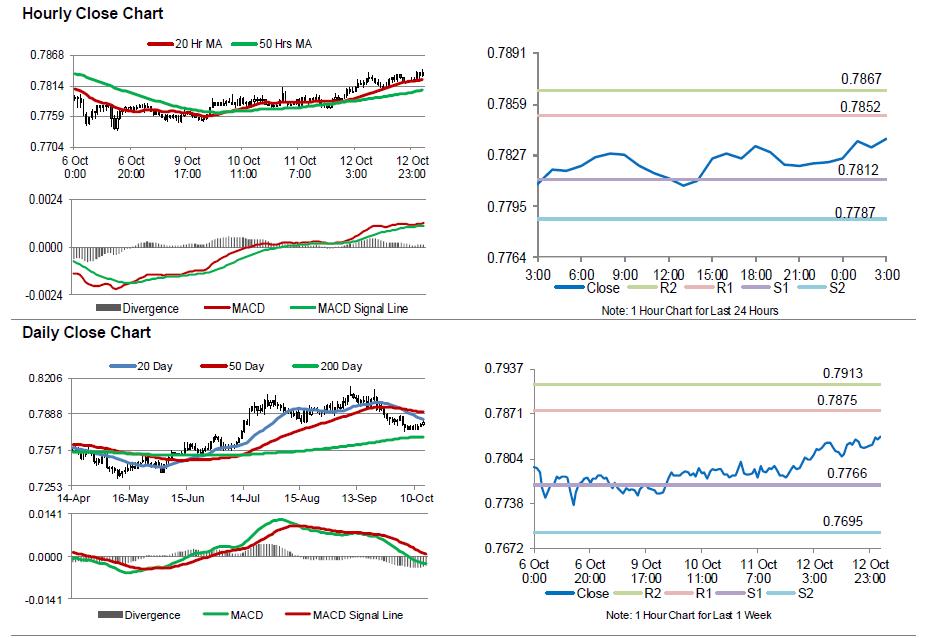

The pair is expected to find support at 0.7812, and a fall through could take it to the next support level of 0.7787. The pair is expected to find its first resistance at 0.7852, and a rise through could take it to the next resistance level of 0.7867.

Next week, market participants would await the release of the RBA’s October meeting minutes along with Australia’s unemployment rate data.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.