For the 24 hours to 23:00 GMT, the AUD rose 0.13% against the USD and closed at 0.7564.

LME Copper prices declined 1.05% or $50.5/MT to $4754.5/MT. Aluminium prices declined 0.18% or $3.0/MT to $1681.0/MT.

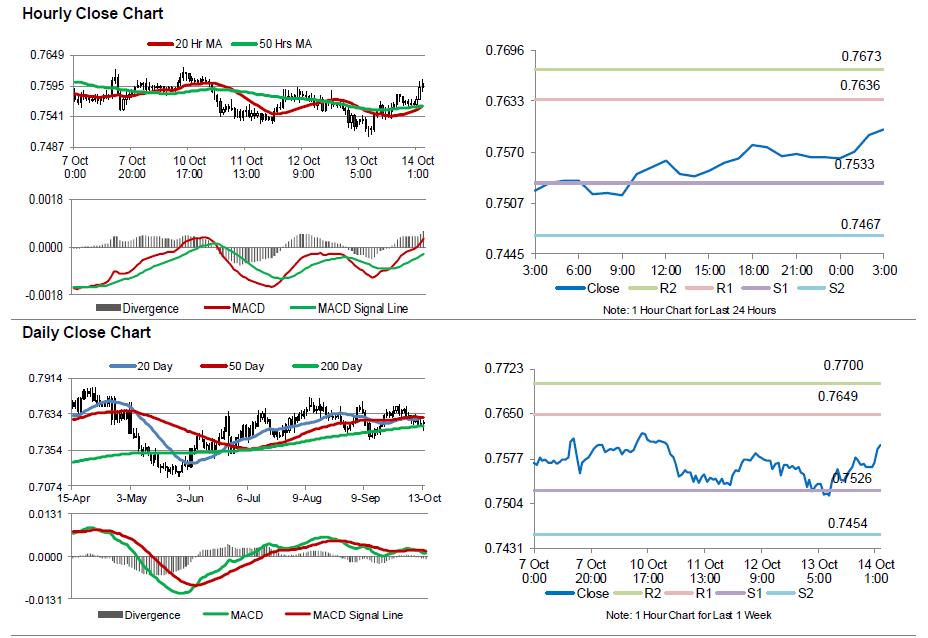

In the Asian session, at GMT0300, the pair is trading at 0.7599, with the AUD trading 0.46% higher against the USD from yesterday’s close.

The Reserve Bank of Australia (RBA), in its biannual Financial Stability Review, highlighted that domestic risks have continued to shift towards property development and warned that threats of oversupply in the apartment construction market are growing in some regions. However, the central bank believed that financial risks in the household sector have lessened since its last review six months ago. Further, it stated that Chinese financial crisis would negatively affect Australia through falling trade volumes and commodity prices but also noted that Australia’s banking system is strong enough to withstand these domestic and global challenges.

Elsewhere, in China, Australia’s largest trading partner, the consumer price index quickened by 0.7% MoM in September, indicating a pick-up in economic growth, surpassing market expectations for the index to advance by 0.3% and compared to a rise of 0.1% in the previous month. Additionally, the nation’s producer price index surprisingly rebounded by 0.1% on an annual basis in September, rising for the first time in nearly five years, against market expectations for a fall of 0.3% and following a drop of 0.8% in the prior month.

The pair is expected to find support at 0.7533, and a fall through could take it to the next support level of 0.7467. The pair is expected to find its first resistance at 0.7636, and a rise through could take it to the next resistance level of 0.7673.

Looking ahead, RBA’s meeting minutes along with its Governor Philip Lowe speech, due next week, would be on investor’s radar. Moreover, Australia’s unemployment rate, NAB business confidence, employment change and Westpac leading index data, all scheduled to release this week, would keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.