For the 24 hours to 23:00 GMT, the AUD rose 0.53% against the USD and closed at 0.7626.

LME Copper prices declined 1.19% or $57.5/MT to $4787.0/MT. Aluminium prices declined 0.25% or $4.0/MT to $1616.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7655, with the AUD trading 0.38% higher against the USD from yesterday’s close.

Overnight data indicated that Australia’s AiG performance of construction index dropped to a level of 51.6 in July, compared to a level of 53.2 in the prior month.

Separately, early this morning, the minutes of the Reserve Bank of Australia’s (RBA) latest monetary policy meeting revealed that the policy makers are increasingly worried about the possible consequences of stronger Australian dollar on the nation’s growth and inflation while acknowledging that the currency is proving to be a significant source of uncertainty. It also forecasted the nation to grow by 2.5% to 3.5% through December and accelerating to around 3% to 4% in 2018. Moreover, the minutes revealed that underlying inflation will likely remain around current rates in the near term, piling pressure for continued low-rate stimulus.

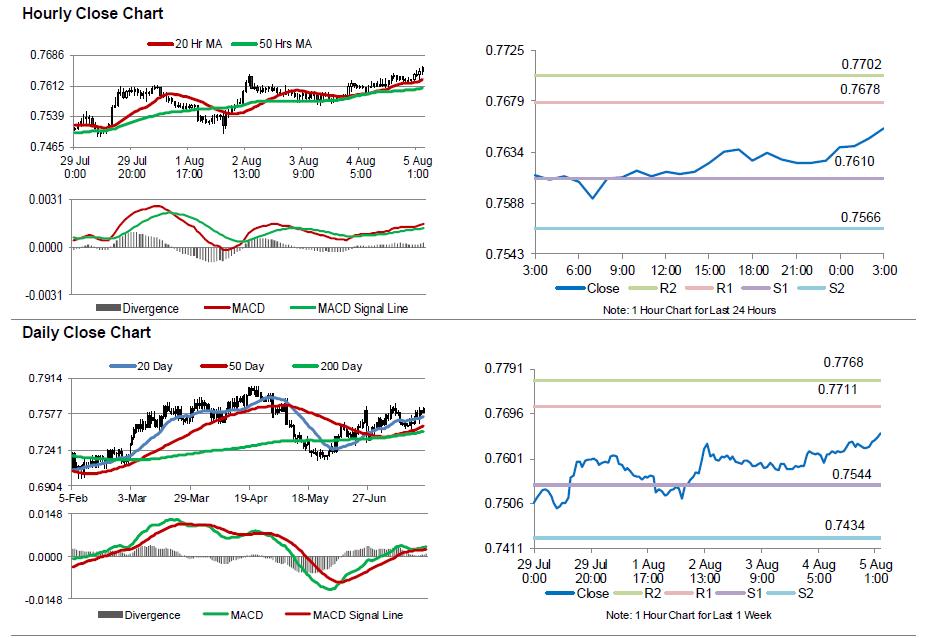

The pair is expected to find support at 0.7610, and a fall through could take it to the next support level of 0.7566. The pair is expected to find its first resistance at 0.7678, and a rise through could take it to the next resistance level of 0.7702.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.