For the 24 hours to 23:00 GMT, the AUD rose 0.08% against the USD and closed at 0.7586.

Yesterday, in China, Australia’s largest trading partner, gross domestic product (GDP) surprisingly expanded 6.9% on an annual basis in 1Q 2017, driven by higher government spending, thus indicating that world’s second largest economy ended the first quarter on a stronger footing. The nation’s economy expanded 6.8% in the prior quarter, while markets anticipated for the GDP to climb 6.8%. Moreover, the nation’s industrial production jumped 7.6% on an annual basis in March, notching its highest level since December 2014. Market anticipation was for industrial production to gain 6.3%, compared to a rise of 6.0% in the previous month. Further, the nation’s retail sales surged 10.9% on an annual basis in March, compared to a similar rise in the prior month, while investors had envisaged for an advance of 9.7%.

LME Copper prices declined 0.5% or $30.0/MT to $5655.0/MT. Aluminium prices declined 0.9% or $17.0/MT to $1890.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7557, with the AUD trading 0.38% lower against the USD from yesterday’s close, after minutes of the Reserve Bank of Australia’s (RBA) recent meeting revealed growing concern about Australia’s jobs and housing market.

According to minutes, policymakers stated that Australia’s labour market is somewhat weaker than expected and warned that the domestic labour and housing markets warranted “careful monitoring” over coming months. However, board members also noted that the Australian economy likely made steady progress in the first quarter of 2017.

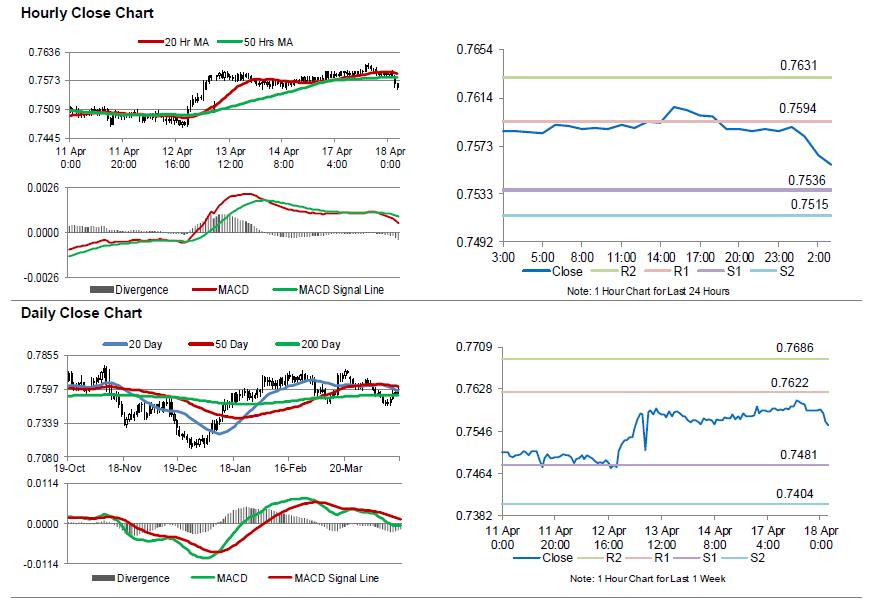

The pair is expected to find support at 0.7536, and a fall through could take it to the next support level of 0.7515. The pair is expected to find its first resistance at 0.7594, and a rise through could take it to the next resistance level of 0.7631.

Going ahead, investors will focus on Australia’s Westpac leading index for March, slated to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.