For the 24 hours to 23:00 GMT, the AUD weakened 0.86% against the USD to close at 0.9269

LME Copper prices declined 0.2% or $14.5/MT to $6980.5/MT. Aluminium prices rose 1.6% or $31.0/MT to $2014.5/MT.

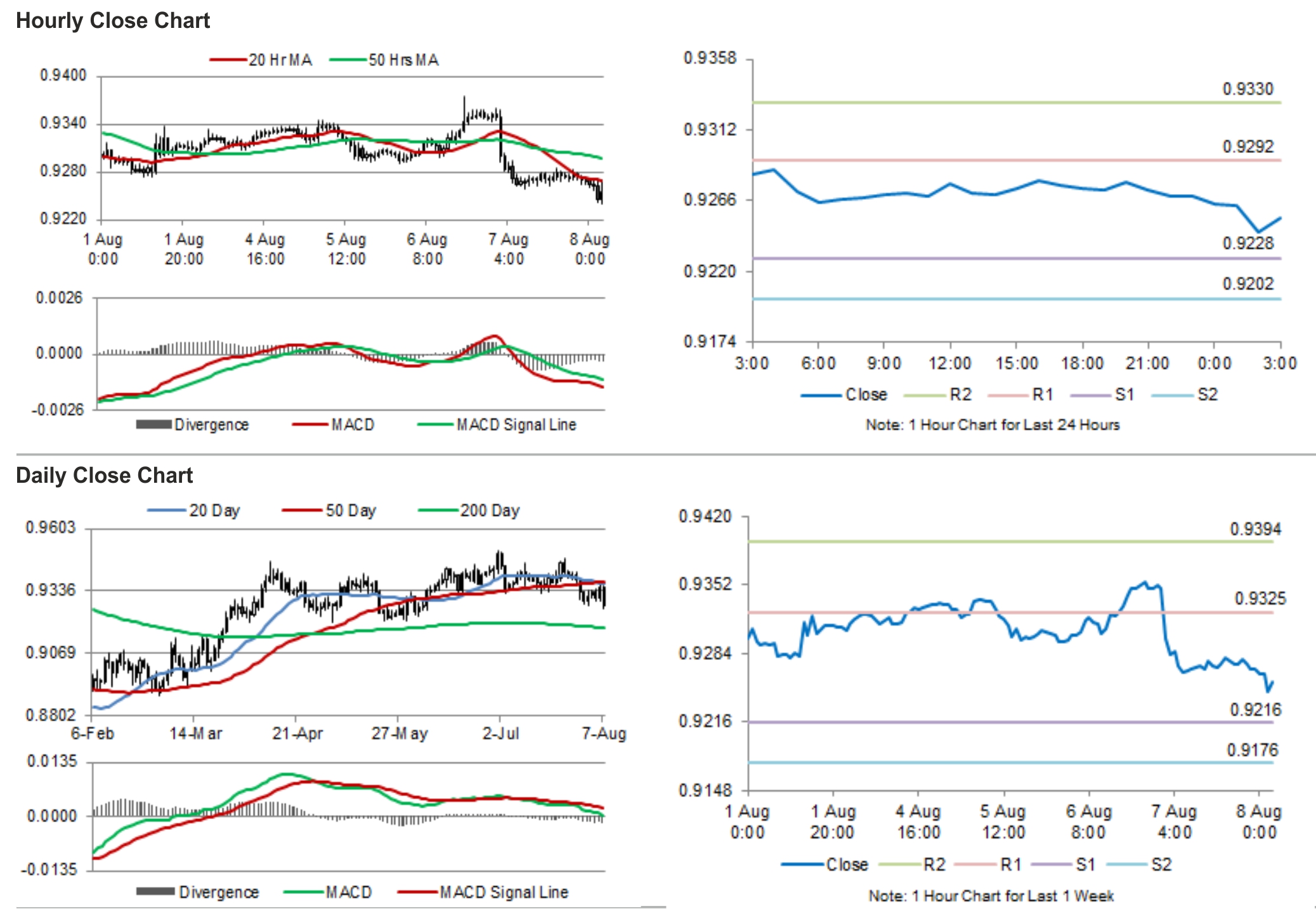

In the Asian session, at GMT0300, the pair is trading at 0.9255, with the AUD trading 0.15% lower from yesterday’s close.

Early this morning, the Reserve Bank of Australia (RBA), in its monetary policy statement, revealed that the central bank policy makers are not considering an interest rate hike anytime soon and the current monetary policy is in line in achieving the inflation target. It further mentioned that the developments in the non-mining business investment remain relatively low and a slack in the job market also resides, which led to the downgrade of the nation’s inflation and growth forecasts. Additionally, the value of loans for owner occupied housing in Australia registered a rise of 1.8% on monthly basis. In the previous month, it had fallen 0.7%.

Meanwhile, China, Australia’s biggest trading partner, posted a trade surplus of USD 47.3 billion in July, the highest it ever post and almost double of market expectations of USD 26.0 billion. In the earlier month, China posted a surplus of USD 31.6 billion. This was because the imports registered an unexpectedly dropped to a 4-month low, while the exports recorded the biggest rise since April 2013.

The pair is expected to find support at 0.9228, and a fall through could take it to the next support level of 0.9202. The pair is expected to find its first resistance at 0.9292, and a rise through could take it to the next resistance level of 0.933.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.