For the 24 hours to 23:00 GMT, the AUD rose 0.52% against the USD and closed at 0.7529.

LME Copper prices rose 0.77% or $52.0/MT to $6837.0/MT. Aluminium prices rose 3.53% or $80.0/MT to $2349.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7549, with the AUD trading 0.27% higher against the USD from yesterday’s close.

Earlier today, the Reserve Bank of Australia (RBA), in its monetary policy statement, expressed confidence that economic growth in the resource-rich economy will accelerate this year and next but remained uncertain over the inflation outlook.

The central bank expects economic growth in Australia to hit 3.25% by the end of this year before surging to 3.55% by June 2019. However, the central bank expects doubts that inflation would reach 2.25% before June 2020.

Elsewhere in China, Australia’s largest trading partner, the Caixin/Markit services PMI recorded an unexpected rise to a level of 52.9 in April, defying market expectations for it to remain steady at a level of 52.3 in the previous month.

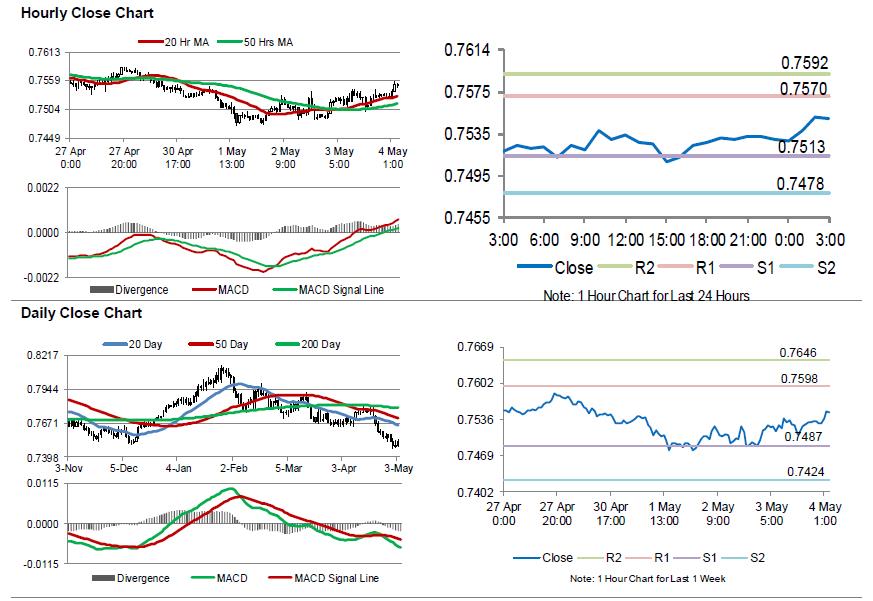

The pair is expected to find support at 0.7513, and a fall through could take it to the next support level of 0.7478. The pair is expected to find its first resistance at 0.7570, and a rise through could take it to the next resistance level of 0.7592.

Going ahead, traders would keep a close watch on Australia’s AiG performance of construction index and the NAB business confidence data, both for April, due to release on Monday.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.