For the 24 hours to 23:00 GMT, the AUD declined 0.95% against the USD and closed at 0.7524.

LME Copper prices rose 1.1% or $54.0/MT to $4907.0/MT. Aluminium prices rose 1.83% or $29.5/MT to $1645.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.754, with the AUD trading 0.21% higher against the USD from yesterday’s close.

Earlier today, the Reserve Bank of Australia (RBA), slashed its key interest rates to a record low of 1.5% to encourage historically weak inflation. In a statement post meeting, the RBA Governor, Glenn Stevens, stated that policy makers found prospects for sustainable growth in the economy, with inflation returning to target gradually.

In other economic news, data indicated that Australia’s trade deficit expanded more-than-expected to a level of A$3195.0 million in June, as imports rose and exports fell, following a revised trade deficit of A$2418.0 million in the prior month, while markets expected the nation to register a trade deficit of A$2000.0 million. Moreover, the nation’s building approvals fell for a second consecutive month, after it unexpectedly eased by 2.9% on a monthly basis in June, compared to investor consensus for an advance of 0.8% and after recording a revised fall of 5.4% in the prior month.

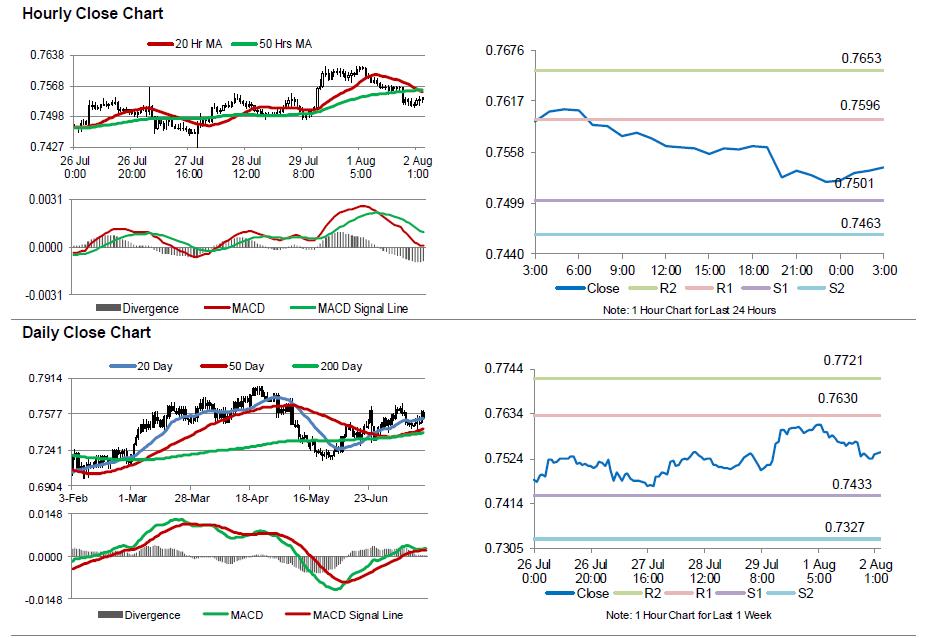

The pair is expected to find support at 0.7501, and a fall through could take it to the next support level of 0.7463. The pair is expected to find its first resistance at 0.7596, and a rise through could take it to the next resistance level of 0.7653.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.