For the 24 hours to 23:00 GMT, the AUD strengthened marginally against the USD to close at 0.7147, after Australia’s construction sector expanded in October.

Data showed that, Australia’s AiG performance of construction index rose to a level of 52.1 in October, from a reading of 51.9 in the previous month.

LME Copper prices declined 2.18% or $112.5/MT to $5053.0/MT. Aluminium prices rose 0.03% or $0.5/MT to $1473.0/MT.

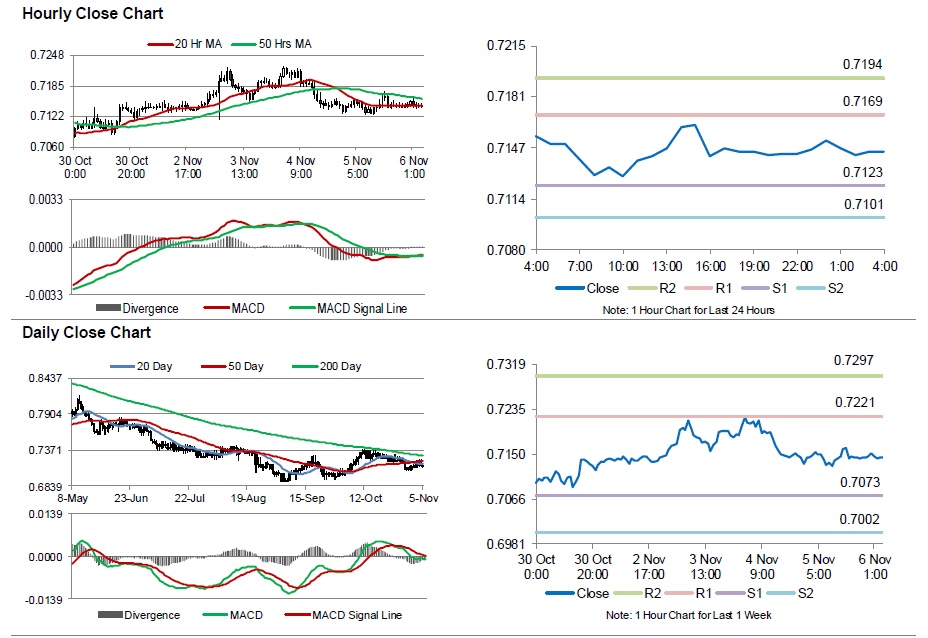

In the Asian session, at GMT0400, the pair is trading at 0.7145, with the AUD trading marginally lower from yesterday’s close.

Earlier this morning, the RBA, in its monetary policy statement, indicated that economic conditions in Australia had improved over the recent months, thus it was appropriate to leave the cash rate unchanged at its November policy meeting. However, the muted pace of inflation in the country left open the chances for further easing of monetary policy, if needed. The central bank further stated that it sees the underlying inflation rate to stay at around 2.0% for most of next year, down from its earlier forecast of 2.5%.

The pair is expected to find support at 0.7123, and a fall through could take it to the next support level of 0.7101. The pair is expected to find its first resistance at 0.7169, and a rise through could take it to the next resistance level of 0.7194.

Moving ahead, market participants will keep an eye on Australia’s unemployment rate data for October, scheduled to be released later next week. Additionally, in China, Australia’s largest trading partner, consumer price inflation and industrial production data, both for the month of October, due next week, will garner a lot of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.