For the 24 hours to 23:00 GMT, the AUD rose 0.12% against the USD and closed at 0.7834.

LME Copper prices declined 0.5% or $30.0/MT to $6455.0/MT. Aluminium prices declined 2.1% or $43.5/MT to $2067.0/MT.

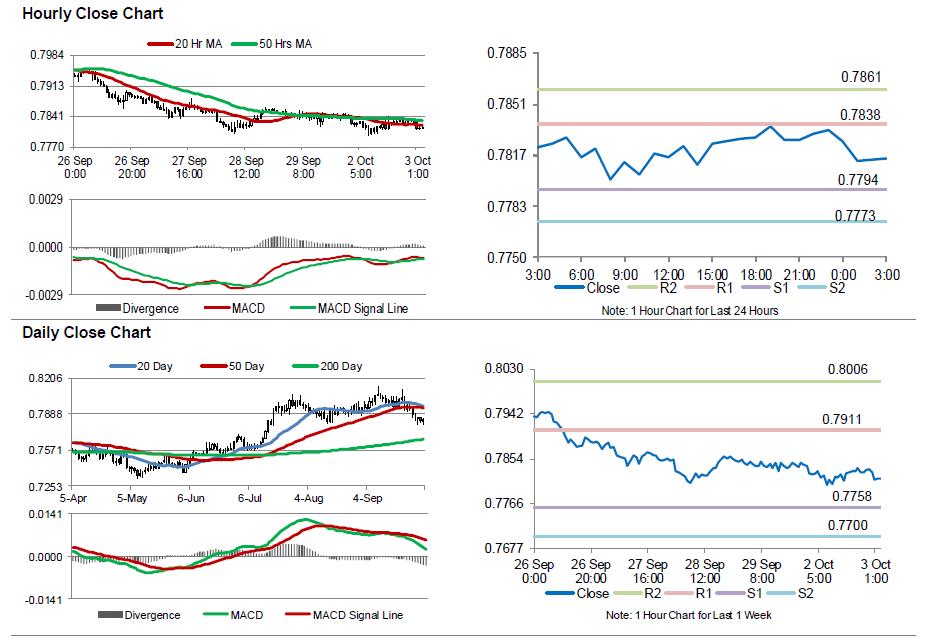

In the Asian session, at GMT0300, the pair is trading at 0.7815, with the AUD trading 0.24% lower against the USD from yesterday’s close.

Earlier today, the Reserve Bank of Australia (RBA) kept key interest rate unchanged at a record low 1.5%, as widely expected. In a post-meeting statement, Governor Philip Lowe highlighted that unemployment rate in Australia was unlikely to fall quickly while adding sluggish wages was going to be a problem for some time. He also stated that the impact of a stronger Australian Dollar is expected to contribute to continued subdued price pressures in the economy.

Overnight data indicated that Australia’s seasonally adjusted building approvals rebounded 0.4% MoM in August, less than market consensus for a gain of 1.0%. In the previous month, building approvals had recorded a revised drop of 1.2%. Moreover, the nation’s new home sales rebounded by 9.1% on a monthly basis in August. In the prior month, new home sales had registered a revised drop of 15.4%.

The pair is expected to find support at 0.7794, and a fall through could take it to the next support level of 0.7773. The pair is expected to find its first resistance at 0.7838, and a rise through could take it to the next resistance level of 0.7861.

Going forward, Australia’s AiG performance of service index for September, slated to release in overnight, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.