For the 24 hours to 23:00 GMT, the AUD declined 0.13% against the USD and closed at 0.7583.

Yesterday, data showed that Australia’s AiG performance of construction index rose to a level of 53.1 in February, from a reading of 47.7 in the previous month.

LME Copper prices declined 0.9% or $54.0/MT to $5856.0/MT. Aluminium prices declined 2.2% or $41.0/MT to $1868.0/MT.

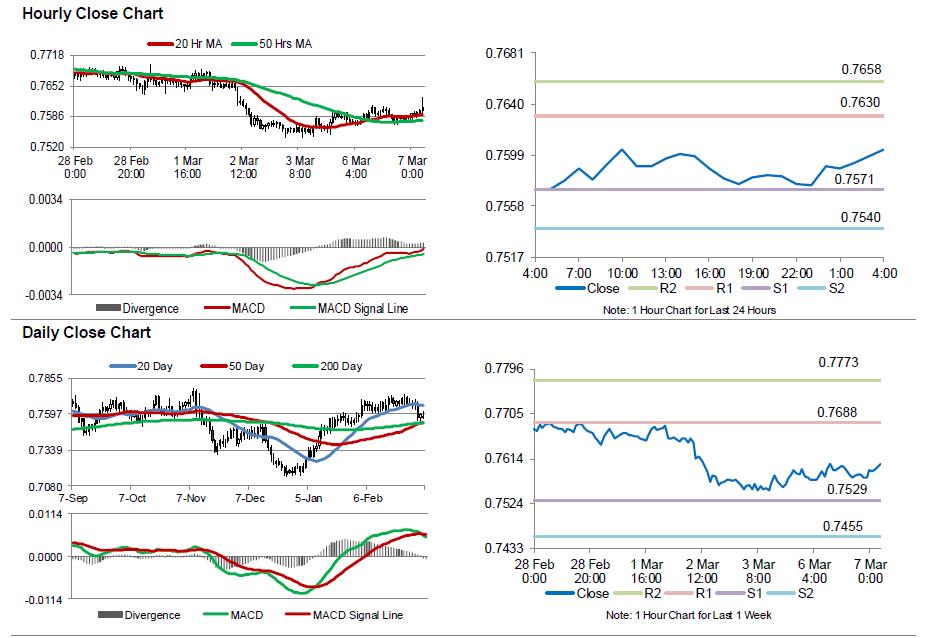

In the Asian session, at GMT0400, the pair is trading at 0.7603, with the AUD trading 0.26% higher against the USD from yesterday’s close.

Earlier today, the Reserve Bank of Australia (RBA), in a widely expected move, maintained the official cash rate steady at a record low level of 1.5% for a sixth straight meeting. The RBA Governor, Philip Lowe stated that global economic conditions have improved over recent months and that the Australian economy continues to transition after the mining boom. He further added that while the nation’s headline inflation is expected to pick up over the course of 2017, there remains considerable variation across the nation’s jobs and housing markets.

The pair is expected to find support at 0.7571, and a fall through could take it to the next support level of 0.7540. The pair is expected to find its first resistance at 0.7630, and a rise through could take it to the next resistance level of 0.7658.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.