For the 24 hours to 23:00 GMT, the AUD rose 0.43% against the USD and closed at 0.7686.

LME Copper prices declined 0.52% or $25.0/MT to $4807.0/MT. Aluminium prices declined 0.51% or $8.5/MT to $1650.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7671, with the AUD trading 0.2% lower against the USD from yesterday’s close.

Earlier today, the Reserve Bank of Australia (RBA), in its monetary policy meeting, maintained its benchmark interest rate at a record low level of 1.50% for a second straight month, as the board decided to wait for new evidence of inflation and economic growth in the nation.

In a statement post meeting, the RBA stated that policymakers found it appropriate to hold the monetary policy unchanged at this meeting, as the current stance would be consistent with sustainable growth in the economy and achieving the inflation target over time. Further, the bank noted that the Australian economy is continuing to grow at a moderate rate and labour market conditions have improved over past years while the global economy is expanding at a lower than average pace.

In other economic news, Australia’s seasonally adjusted building permits dropped by 1.8% on a monthly basis in August, less than market expectations for a fall of 6.0% and following a revised gain of 12.0% in the previous month.

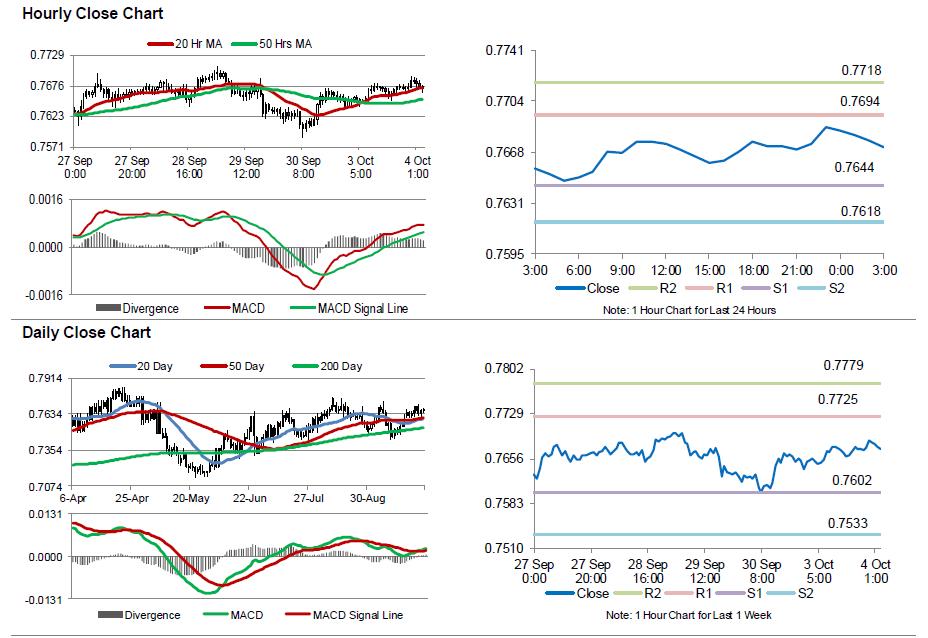

The pair is expected to find support at 0.7644, and a fall through could take it to the next support level of 0.7618. The pair is expected to find its first resistance at 0.7694, and a rise through could take it to the next resistance level of 0.7718.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.