For the 24 hours to 23:00 GMT, the AUD declined 0.5% against the USD and closed at 0.7883.

LME Copper prices declined 0.2% or $16.0/MT to $7050.0/MT. Aluminium prices declined 1.2% or $26.0/MT to $2202.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7862, with the AUD trading 0.27% lower against the USD from yesterday’s close, after data showed that Australia unexpectedly posted a huge deficit in December.

Earlier today, the Reserve Bank of Australia (RBA), at its February monetary policy meeting, opted to keep the official cash rate at record low of 1.50%, citing continuing concerns about weak household consumption. In its post-meeting statement, the central bank indicated that while business conditions and investment were improving in the economy, household consumption remained a source of uncertainty.

On the economic front, Australia surprisingly posted a seasonally adjusted trade deficit of A$1358.0 million in December, amid a surge in imports and confounding market expectations for a surplus of A$200.0 million. The nation had registered a revised surplus of A$36.0 million in the prior month. Moreover, the nation’s seasonally adjusted retail sales retreated 0.5% on a monthly basis in December, exceeding market expectations for a fall of 0.2%. Retail sales had advanced 1.2% in the previous month.

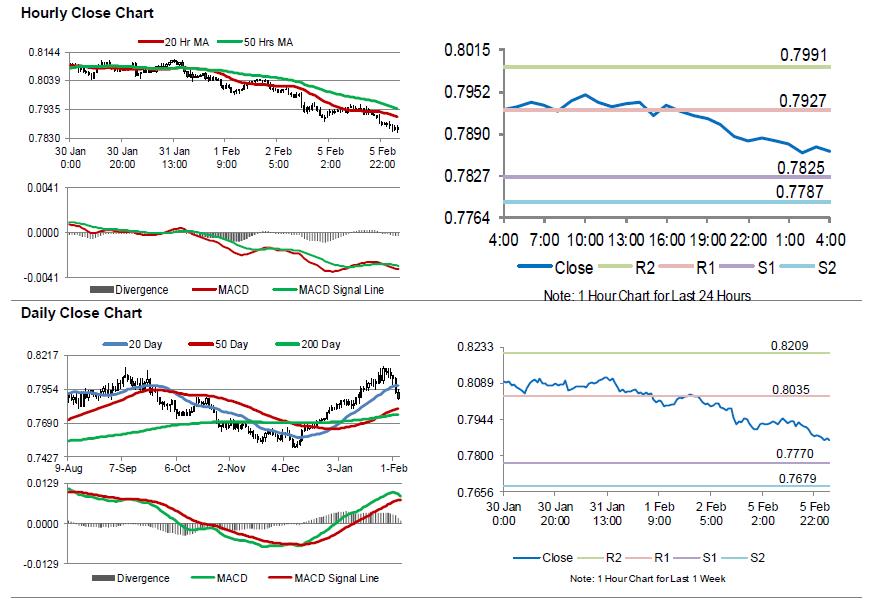

The pair is expected to find support at 0.7825, and a fall through could take it to the next support level of 0.7787. The pair is expected to find its first resistance at 0.7927, and a rise through could take it to the next resistance level of 0.7991.

Going ahead, traders would eye the release of Australia’s AiG performance of construction index for January, slated to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.