For the 24 hours to 23:00 GMT, the AUD rose 0.11% against the USD and closed at 0.7611.

LME Copper prices rose 0.85% or $40.5/MT to $4827.5/MT. Aluminium prices rose 1.26% or $21.5/MT to $1723.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7648, with the AUD trading 0.49% higher against the USD from yesterday’s close, after the Reserve Bank of Australia (RBA), in a widely expected move, left the benchmark interest rates unchanged at 1.5% at its November monetary policy meeting.

In a post meeting statement, the RBA Governor, Philip Lowe, stated that having eased monetary policy at its May and August meetings, the board found it prudent to hold the key interest rate steady at this meeting as it would be best for achieving the central bank’s output growth target and to boost inflation in the nation. Further, he expressed confidence in the nation’s economy and added that it will continue to grow at its “potential rate” before gradually strengthening, with inflation expected to quicken over the next two years.

In other economic news, Australia’s AiG performance of manufacturing index rose to a level of 50.9 in October, crawling out of the contraction territory, following a level of 49.8 in the prior month.

Elsewhere in China, Australia’s largest trading partner, the NBS manufacturing PMI surprisingly advanced to its highest level in more than two years of 51.2 in October, highlighting that the world’s second largest economy is stabilizing. Market expected the index to fall to a level of 50.3, after recording a reading of 50.4 in the prior month. Moreover, the nation’s NBS non-manufacturing PMI climbed to a level of 54.0 in October, compared to a reading of 53.7 in the prior month. Further, the nation’s Caixin/Markit manufacturing PMI unexpected jumped to a level of 51.2 in October, recording the fastest pace of expansion since March 2011 and confounding market anticipation for the index to remain steady at a level of 50.1, recorded in the preceding month.

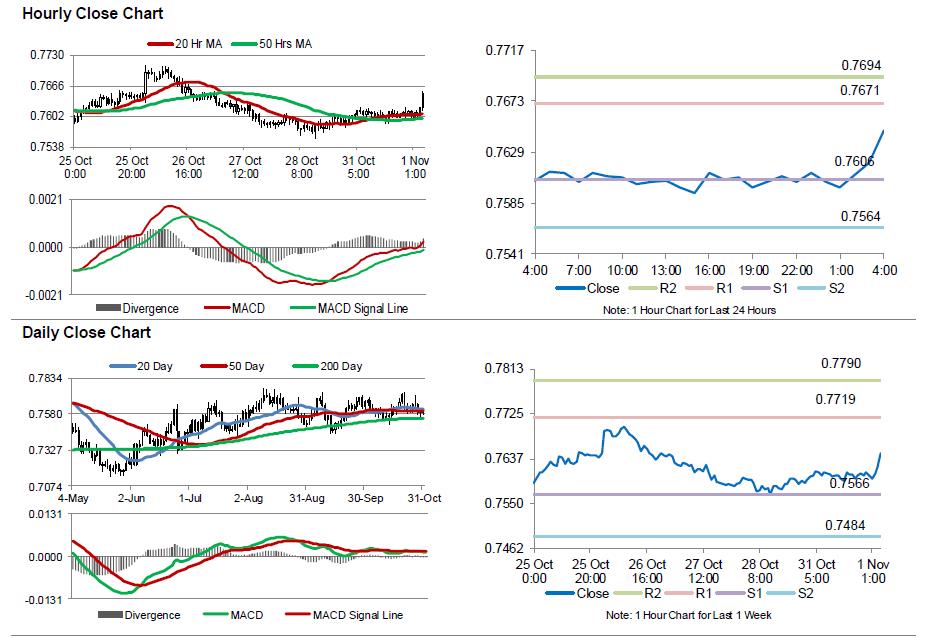

The pair is expected to find support at 0.7606, and a fall through could take it to the next support level of 0.7564. The pair is expected to find its first resistance at 0.7671, and a rise through could take it to the next resistance level of 0.7694.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.