For the 24 hours to 23:00 GMT, the AUD strengthened 0.43% against the USD to close at 0.7288.

LME Copper prices declined 0.42% or $19.5/MT to $4640.5/MT. Aluminium prices declined 0.23% or $3.5/MT to $1525.5/MT.

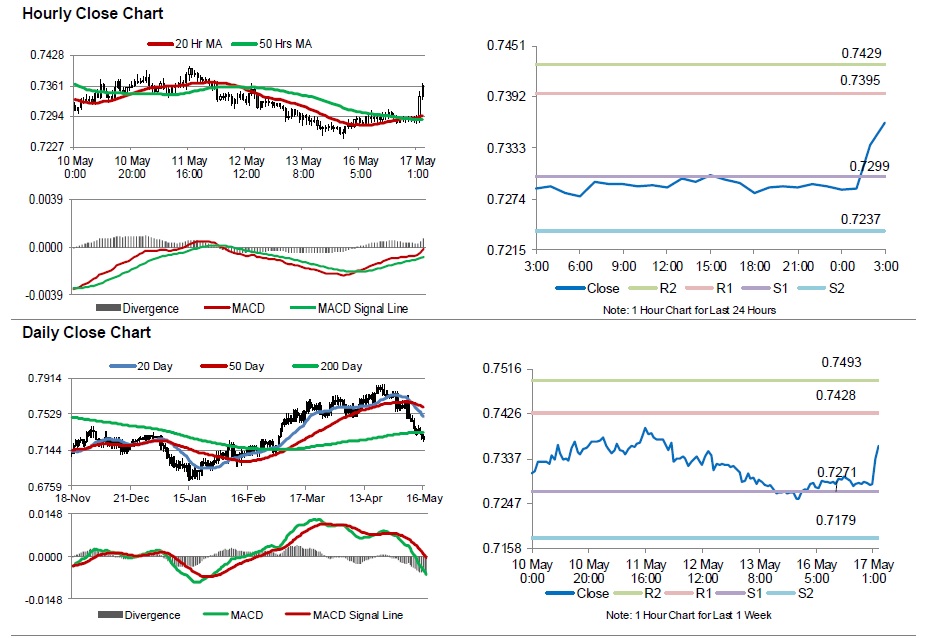

In the Asian session, at GMT0300, the pair is trading at 0.7362, with the AUD trading 1.02% higher from yesterday’s close.

Early this morning, the Reserve Bank of Australia’s (RBA) May monetary policy meeting minutes revealed that, policymakers were reluctant to cut the official cash rate, but then decided to go ahead and reduce the interest rate due to the broad-based weakness in prices and labour costs that signalled less momentum in domestic inflationary pressures. However, the RBA reiterated its confidence in the underlying strength of the Australian economy, and its ongoing attempt at rebalancing away from resource-related infrastructure investment. The minutes gave little guidance on whether the central bank would cut interest rate again.

The pair is expected to find support at 0.7299, and a fall through could take it to the next support level of 0.7237. The pair is expected to find its first resistance at 0.7395, and a rise through could take it to the next resistance level of 0.7429.

Moving ahead, market participants will look forward to Australia’s Westpac leading index for April, scheduled to release in the early hours tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.