For the 24 hours to 23:00 GMT, the AUD rose 0.39% against the USD and closed at 0.7676.

LME Copper prices traded flat to trade at $4746.0/MT. Aluminium prices rose 0.58% or $9.5/MT to $1644.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7675, with the AUD trading a tad lower against the USD from yesterday’s close.

The minutes of the Reserve Bank of Australia’s (RBA) latest monetary policy meeting, released early in the morning, offered little hints on whether the central bank would consider cutting interest rates beyond the already historic-low level. Further, the minutes revealed that policymakers judged that prospects for growth would be improved and that there was room for stronger growth, provided that interest rates remain low for some time. It also indicated that risks associated with rising household sector leverage and rapid gains in housing prices had cooled.

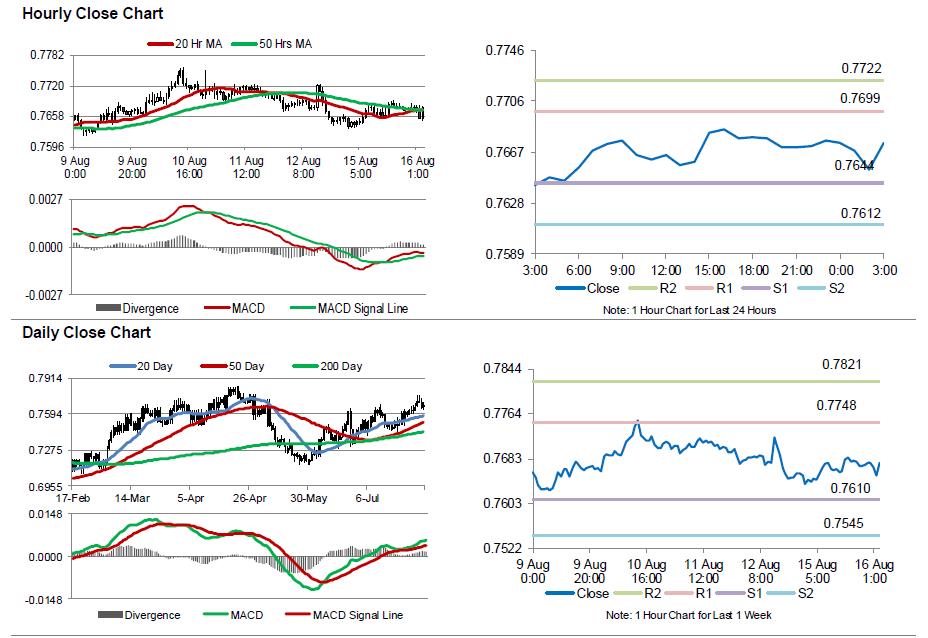

The pair is expected to find support at 0.7644, and a fall through could take it to the next support level of 0.7612. The pair is expected to find its first resistance at 0.7699, and a rise through could take it to the next resistance level of 0.7722.

Going ahead, AUD traders would focus on Australia’s Westpac leading index data for June, slated to release overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.