For the 24 hours to 23:00 GMT, the AUD rose 0.12% against the USD and closed at 0.7668.

LME Copper prices rose 1.6% or $108.5/MT to $6844.0/MT. Aluminium prices gained 0.6% or $11.5/MT to $2047.5/MT.

The Reserve Bank of Australia (RBA), in its minutes of the December meeting, stated that recent data had increased confidence that there would be further progress on fronts such as unemployment, inflation and household debt in 2018. The central bank expects employment growth to continue over the coming quarters but remained concerned over household consumption and the outlook for higher wages. The RBA warned that weakness in consumer spending remains a major risk for the economy amid slow wage growth and high debt levels.

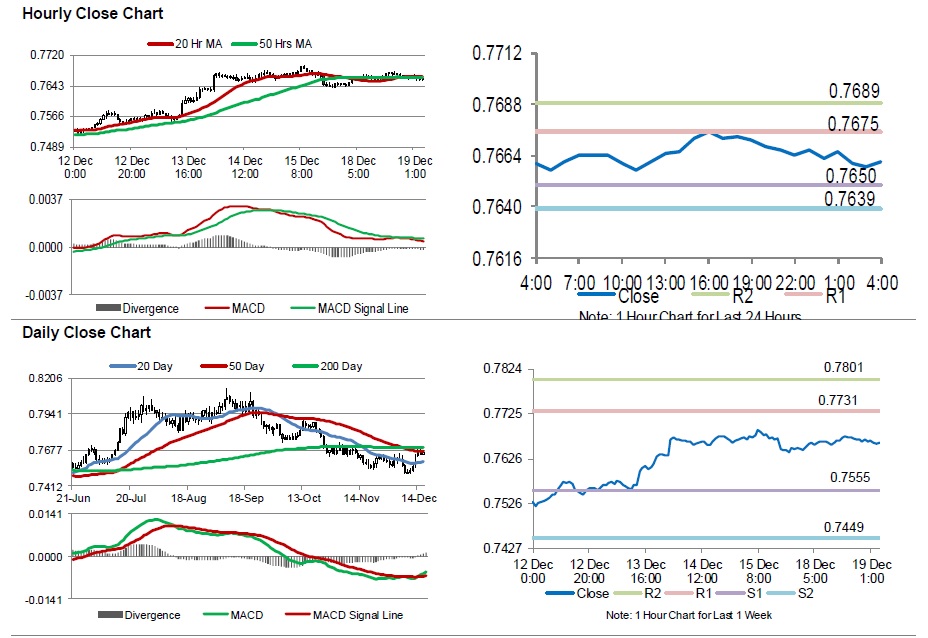

In the Asian session, at GMT0400, the pair is trading at 0.7661, with the AUD trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 0.7650, and a fall through could take it to the next support level of 0.7639. The pair is expected to find its first resistance at 0.7675, and a rise through could take it to the next resistance level of 0.7689.

Going forward, investors would now turn their attention to Australia’s Westpac leading index for November, due to release overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.