For the 24 hours to 23:00 GMT, the AUD declined 0.24% against the USD and closed at 0.7408.

LME Copper prices declined 1.7% or $93.5/MT to $5543.0/MT. Aluminium prices declined 0.3% or $6.5/MT to $1909.5/MT.

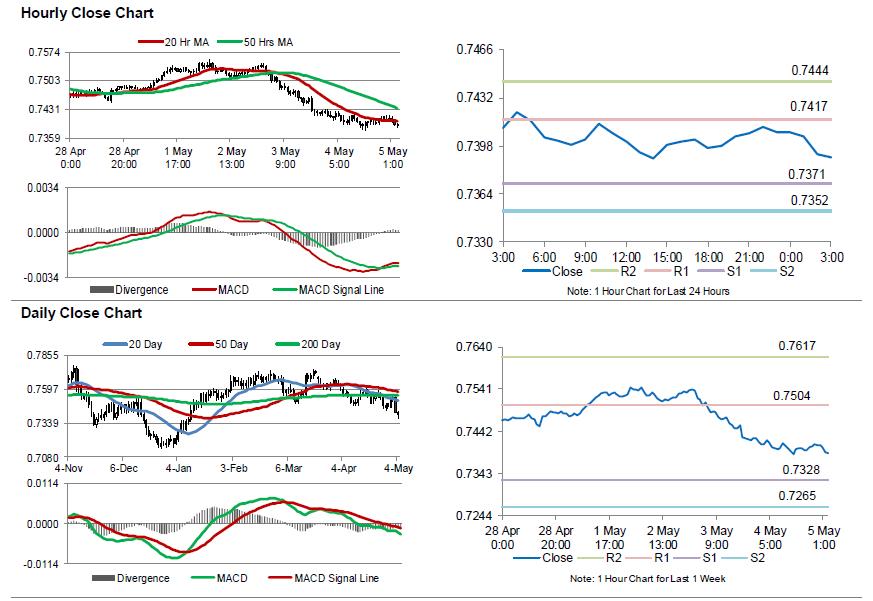

In the Asian session, at GMT0300, the pair is trading at 0.739, with the AUD trading 0.24% lower against the USD from yesterday’s close.

Earlier in the session, the Reserve Bank of Australia (RBA), in its quarterly statement on monetary policy, forecasted that Australian economy would grow between 2.75% to 3.75% in 2018, up from its previous prediction of 2.5% to 3.5%. The central bank further warned that slow wage growth looks set to continue for Australian workers and remains a potential drag on the economy and that it had no plan to shift the cash rate from a record low of 1.5% for the rest of 2017.

Overnight data indicated that Australia’s AIG performance of construction index advanced to a level of 51.9 in April, after registering a reading of 51.2 in the previous month.

The pair is expected to find support at 0.7371, and a fall through could take it to the next support level of 0.7352. The pair is expected to find its first resistance at 0.7417, and a rise through could take it to the next resistance level of 0.7444.

Moving ahead, Australia’s building approvals, NAB business confidence, retail sales and Westpac consumer confidence data, all slated to release next week, will be on investors radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.