For the 24 hours to 23:00 GMT, the AUD rose 0.23% against the USD and closed at 0.7715.

Yesterday, the Reserve Bank of Australia’s (RBA) Governor, Philip Lowe, indicated that he expects “a period of stability” in the official cash rate, warning that further cuts in interest rate could push already high household debt to “dangerous” levels.

LME Copper prices rose 0.3% or $15.0/MT to $5991.0/MT. Aluminium prices rose 0.5% or $9.5/MT to $1882.5/MT.

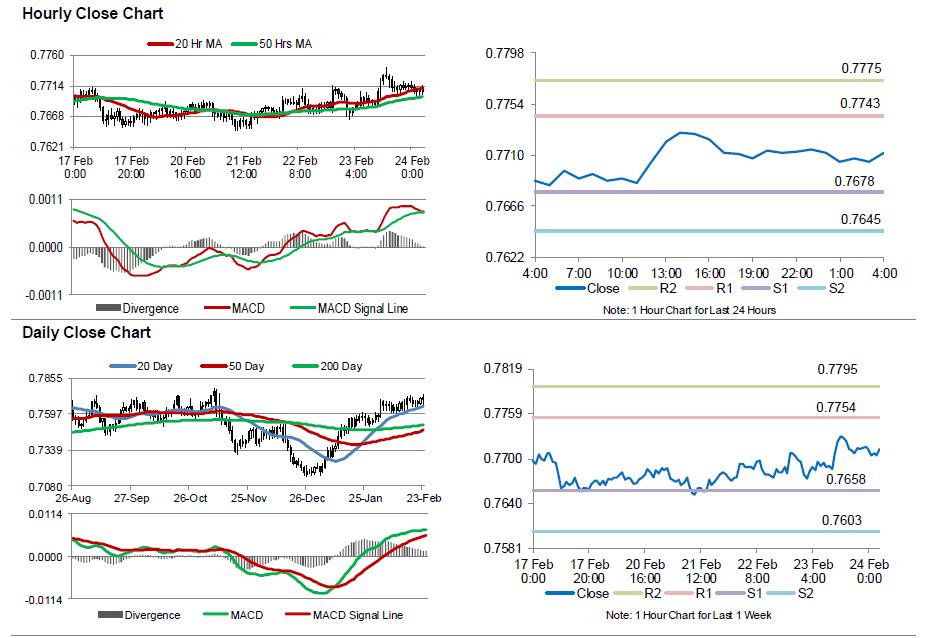

In the Asian session, at GMT0400, the pair is trading at 0.7712, with the AUD trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 0.7678, and a fall through could take it to the next support level of 0.7645. The pair is expected to find its first resistance at 0.7743, and a rise through could take it to the next resistance level of 0.7775.

Next week, market participants will closely monitor Australia’s Q4 GDP, AiG performance of manufacturing and services indices, HIA new home sales and trade balance data, to gauge the strength in the nation’s economy.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.