For the 24 hours to 23:00 GMT, the AUD strengthened 0.33% against the USD to close at 0.7798, rebounding from its previous session losses.

LME Copper prices declined 0.46% or $26.0/MT to $5666.0/MT. Aluminium prices declined 0.88% or $16.5/MT to $1855.0/MT.

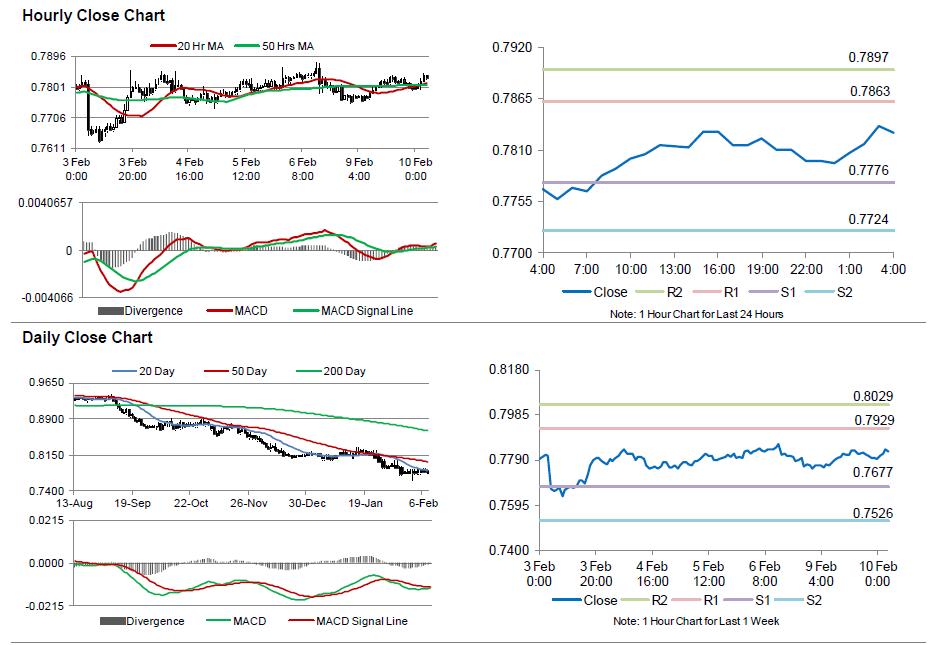

In the Asian session, at GMT0400, the pair is trading at 0.7829, with the AUD trading 0.39% higher from yesterday’s close.

Early morning data showed that consumer prices in China, Australia’s biggest trading partner, slipped to a 5-year low of 0.8% on a YoY basis in January, compared to prior month’s level of 1.5%, while markets expected it to drop to 1.0%, thus indicating that the risk of deflation was increasing in the world’s second biggest economy. Additionally, the nation’s producer price index (PPI) eased more than expected by 4.3% on an annual basis in January, against market expectations of 3.8%. It had fallen 3.3% in the preceding month.

In Australia, the NAB indicated that business confidence index climbed to a level of 3.0 in January, following a reading of 2.0 recorded in December, while business conditions remained flat at a level of 2.0 in January. Meanwhile, the nation’s house price index advanced 6.8% on a YoY basis in 4Q 2014, lower than market expected rise of 7.1%. The index had registered a revised level of 9.0% in the prior quarter.

Furthermore, the NAB mentioned that the Australian economy was losing momentum and forecasted that the RBA would go for a second interest rate cut in May.

The pair is expected to find support at 0.7776, and a fall through could take it to the next support level of 0.7724. The pair is expected to find its first resistance at 0.7863, and a rise through could take it to the next resistance level of 0.7897.

Going forward, market participants would concentrate on Australia’s home loans and investment lending data, scheduled in the early hours tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.