For the 24 hours to 23:00 GMT, the AUD strengthened 0.32% against the USD to close at 0.7800.

LME Copper prices rose 0.54% or $30.0/MT to $5535.0/MT. Aluminium prices rose 0.79% or $14.5/MT to $1852.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7668, with the AUD trading 1.69% lower from yesterday’s close, after the RBA surprisingly slashed its key interest rate for the first time since August 2013 to a record low of 2.25%, lowering it from 2.50%. Additionally, the RBA Governor, Glenn Stevens, in his statement accompanying the interest rate decision mentioned that rates were trimmed because of the nation’s soft economic growth, weak inflation and the elevated value of the Aussie.

Early morning data showed that Australia’s trade deficit narrowed more than expected to A$436 million in December, against market expectations to fall to A$850 million and compared to a revised deficit of A$1016 million recorded in prior month. Meanwhile, building approvals in the nation fell 3.3% on a MoM basis in December, following a revised advance of 7.7% registered in November, while markets were expecting it to ease 5.0%.

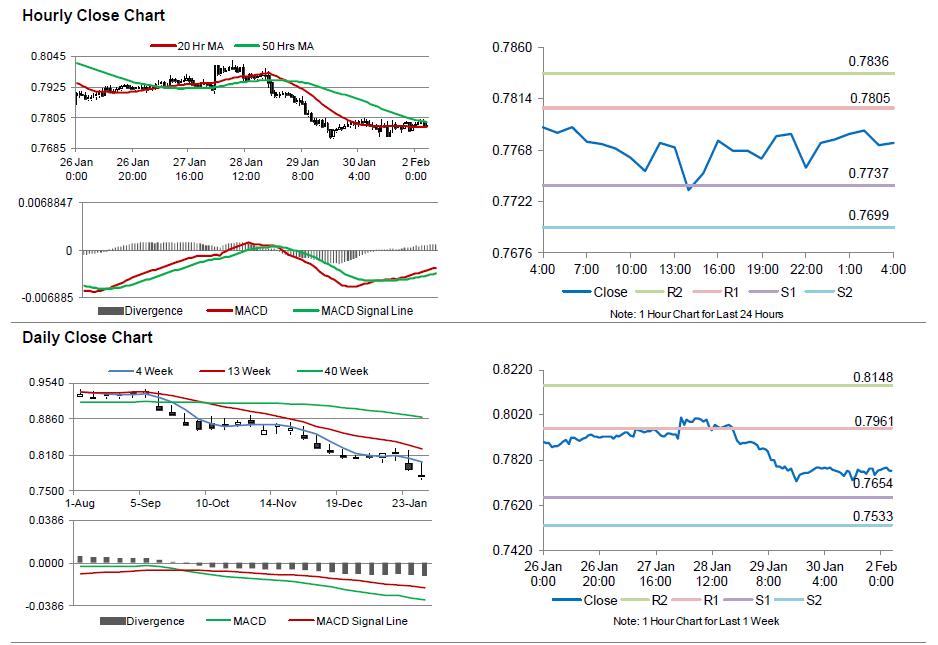

The pair is expected to find support at 0.7601, and a fall through could take it to the next support level of 0.7534. The pair is expected to find its first resistance at 0.7785, and a rise through could take it to the next resistance level of 0.7902.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.