For the 24 hours to 23:00 GMT, the AUD weakened 0.88% against the USD to close at 0.7605.

LME Copper prices declined 1.31% or $64.0/MT to $4816.0/MT. Aluminium prices declined 0.07% or $1.0/MT to $1523.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7572, with the AUD trading 0.42% lower from yesterday’s close.

Overnight data showed that Australia’s AiG performance of services index entered into contractionary territory with a reading of 49.5 in March. The index had recorded a reading of 51.8 in the prior month.

Early this morning, the RBA kept interest rate steady at 2.0%, as widely expected. The central bank Governor, Glenn Stevens, in contrast to his March statement, indicated that an appreciation in the Australian dollar could complicate the adjustment currently under way in the nation’s economy. He further added that continued low inflation would provide scope for further monetary easing, if it lends support to demand.

In other economic news, Australia’s trade deficit widened to a record level of A$3410.0 million in February, following a revised trade deficit of A$3156.0 million in the prior month. Markets were anticipating a trade deficit of A$2500.0 million. The nation’s exports fell 1.0%, while imports remained flat in February.

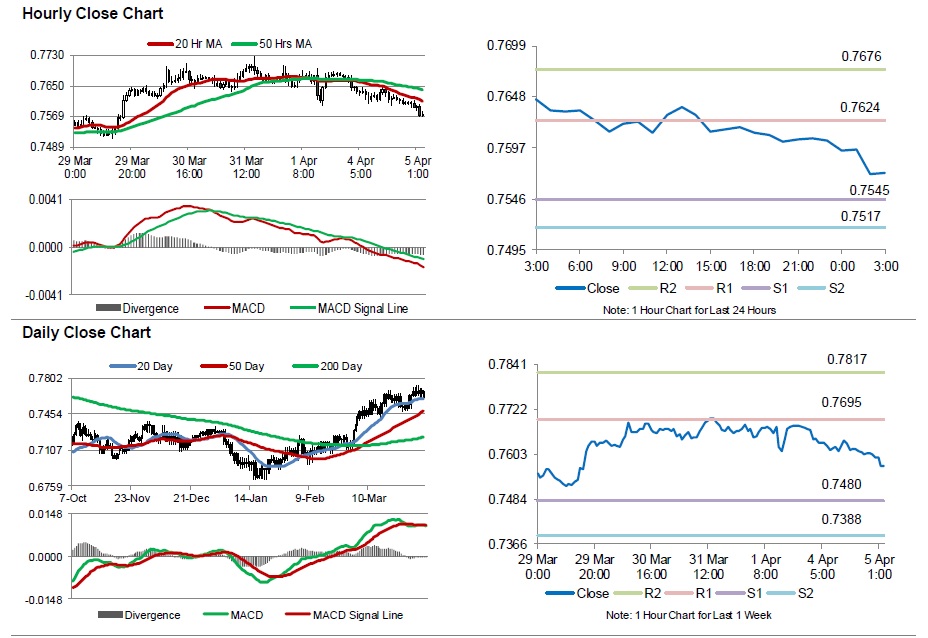

The pair is expected to find support at 0.7545, and a fall through could take it to the next support level of 0.7517. The pair is expected to find its first resistance at 0.7624, and a rise through could take it to the next resistance level of 0.7676.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.