For the 24 hours to 23:00 GMT, the AUD weakened 0.45% against the USD to close at 0.7276.

LME Copper prices declined 0.83% or $43.5/MT to $5176.5/MT. Aluminium prices declined 1.88% or $30.0/MT to $1564.0/MT.

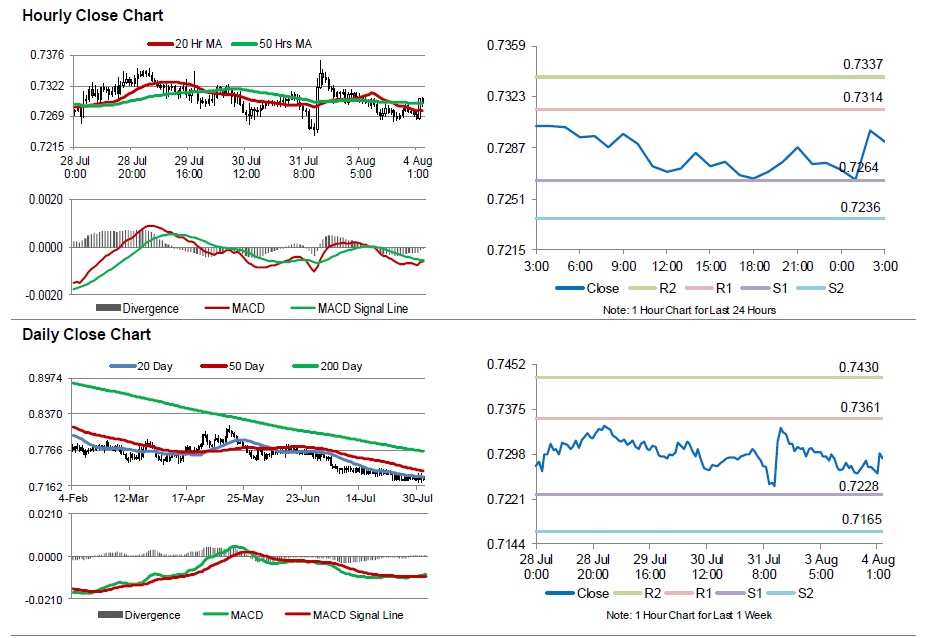

In the Asian session, at GMT0300, the pair is trading at 0.7291, with the AUD trading 0.2% higher from yesterday’s close.

The RBA opted to keep its benchmark interest rates unchanged at a record low of 2.0% for the third successive month, citing major decline in key commodity prices.

Data released showed that retail sales in Australia rose more than expected by 0.7% on a monthly basis, marking its biggest gain since February in June, following a 0.3% increase recorded in the previous month. Meanwhile, the nation’s trade deficit widened to A$2,933.0 million in June, compared to a deficit of A$2,751.0 million in the prior month.

The pair is expected to find support at 0.7264, and a fall through could take it to the next support level of 0.7236. The pair is expected to find its first resistance at 0.7314, and a rise through could take it to the next resistance level of 0.7337.

Market participants would now keep an eye on Australia’s employment data, scheduled in the week ahead.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.