For the 24 hours to 23:00 GMT, the AUD weakened 0.60% against the USD to close at 0.7759.

LME Copper prices rose 0.26% or $15.5/MT to $5896.0/MT. Aluminium prices rose 0.14% or $2.5/MT to $1797.0/MT.

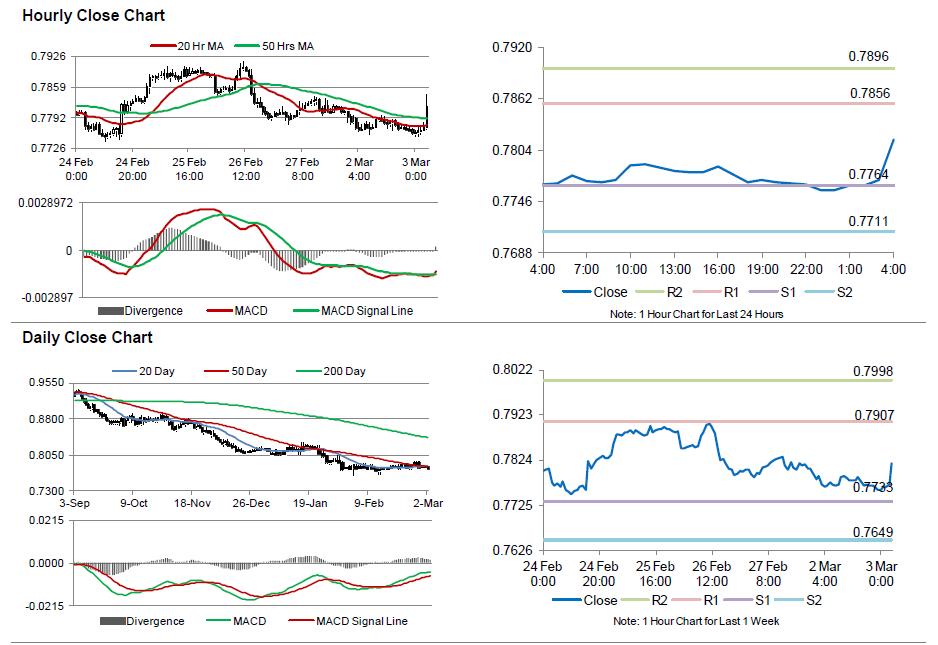

In the Asian session, at GMT0400, the pair is trading at 0.7816, with the AUD trading 0.74% higher from yesterday’s close.

Earlier today, the RBA kept its interest rate unchanged at a historic record low of 2.25%, citing below trend pace of growth and expectations that inflation will remain consistent with its target over the next one to two years. It also indicated that a lower exchange rate was required to achieve balanced growth in the economy.

Early morning data showed that building approvals in Australia unexpectedly climbed 7.9% on a monthly basis in January, compared to a revised fall of 2.8% registered in the preceding month. Markets were expecting it to drop 2.0%. Meanwhile, the nation’s current account deficit narrowed more than expected to AUD9.6 billion in 4Q 2014, following a deficit of AUD12.1 billion.

The pair is expected to find support at 0.7764, and a fall through could take it to the next support level of 0.7711. The pair is expected to find its first resistance at 0.7856, and a rise through could take it to the next resistance level of 0.7896.

Going forward, investors await Australia’s crucial 4Q GDP data, scheduled tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.