For the 24 hours to 23:00 GMT, the AUD strengthened 0.37% against the USD to close at 0.7617.

Yesterday, the IMF indicated that the RBA needs to cut its interest rates again, as inflation was slowing down too quickly in Australia. Additionally, the agency cut the nation’s growth outlook to 2.8% in 2015, from its earlier prediction of 2.9%.

LME Copper prices declined 1.58% or $95.0/MT to $5916.5/MT. Aluminium prices declined 0.62% or $11.0/MT to $1770.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7599, with the AUD trading 0.23% lower from yesterday’s close.

Early morning data showed that Australia’s Westpac consumer confidence index dropped 3.20% MoM to a level of 96.20 in April. The index had registered a reading of 99.50 in the previous month.

Elsewhere, in China, Australia’s biggest trading partner, annual economic growth slowed to a 6-year low of 7% in the first quarter of 2015, from 7.3% growth recorded in the previous quarter, thus indicating that the world’s second biggest economy was facing increased downward pressures. Also, industrial production in the nation rose 6.40% YoY in March, compared to a rise of 6.80% in the prior month. Markets were anticipating it to climb 6.90%.

Other economic data indicated that retail sales in China advanced 10.2% on an annual basis in March, lower than market expected increase of 10.9% and compared to prior month’s 11.9% rise.

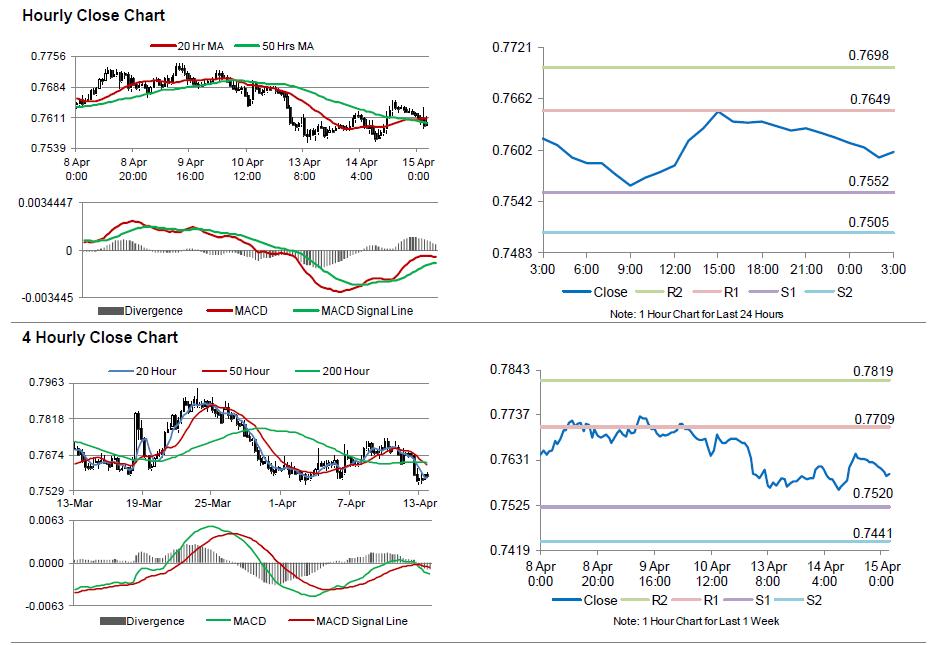

The pair is expected to find support at 0.7552, and a fall through could take it to the next support level of 0.7505. The pair is expected to find its first resistance at 0.7649, and a rise through could take it to the next resistance level of 0.7698.

Going forward, investors await Australia’s unemployment rate coupled with consumer inflation expectation data, scheduled in the early hours tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.