For the 24 hours to 23:00 GMT, the AUD rose 0.07% against the USD and closed at 0.7154.

LME Copper prices declined 1.5% or $86.5/MT to $5860.0/MT. Aluminium prices declined 1.5% or $30.5/MT to $1985.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7192, with the AUD trading 0.53% higher against the USD from yesterday’s close, following the release of Australia’s house price data and RBA meeting minutes.

The minutes of the Reserve Bank of Australia’s (RBA) September monetary policy meeting showed that the policymakers sounded optimistic on strong labour market and resilient domestic consumption. However, the officials expressed concerns over the impact of escalating US-China trade tensions and cautioned that it could pose a “material risk” to the economy. Further, the members maintained their cautiously optimistic forecasts and stated that the next interest rate move was likely to be up.

On the data front, Australia’s house price index eased 0.6% on an annual basis in 2Q 2018, less than market expectations for a decline of 0.7% and compared to an advance of 2.0% in the previous quarter.

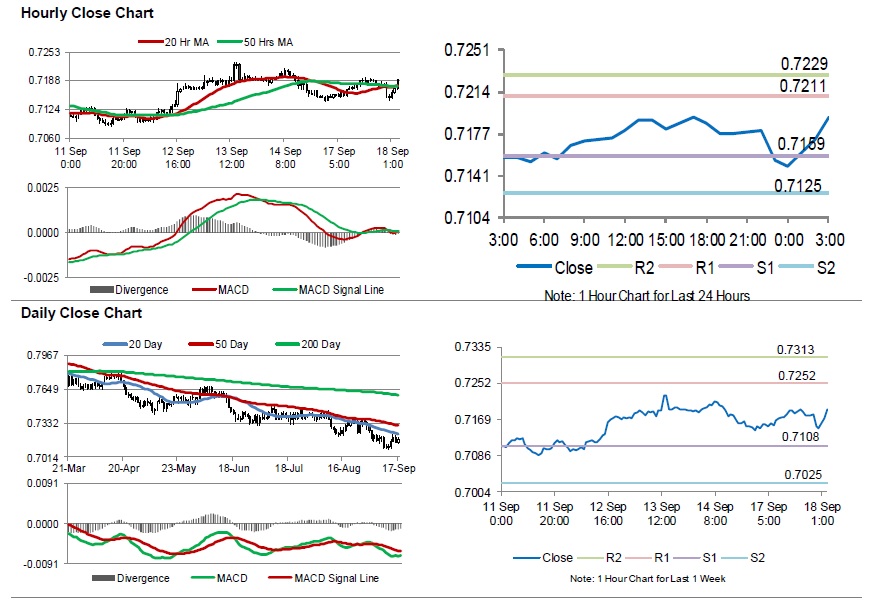

The pair is expected to find support at 0.7159, and a fall through could take it to the next support level of 0.7125. The pair is expected to find its first resistance at 0.7211, and a rise through could take it to the next resistance level of 0.7229.

Trading trend in the Aussie is expected to be determined by Australia’s Westpac leading index for August, set to release overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.