For the 24 hours to 23:00 GMT, AUD marginally strengthened against the USD to close at 0.9023.

LME Copper prices rose 0.8% or $54.5/MT to $7174.5/MT. Aluminium prices advanced 0.9% or $15.0/MT to $1686.0/MT.

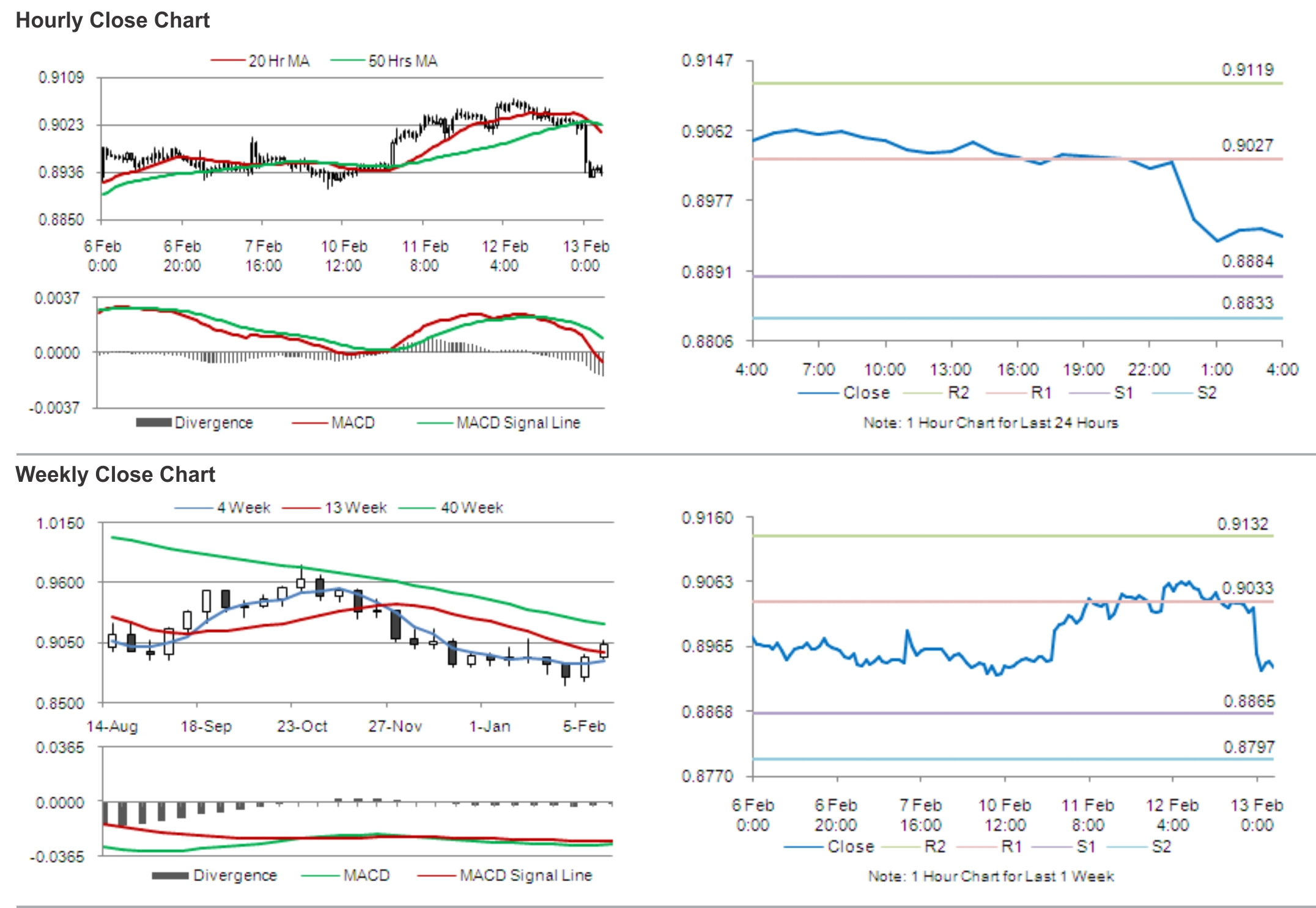

In the Asian session, at GMT0400, the pair is trading at 0.8934, with the AUD trading 0.99% lower from yesterday’s close, after data showed that, on a seasonally adjusted basis, unemployment rate in Australia rose more-than-expected to 6.0% in January, from previous month’s level of 5.8%.

Negative sentiment for the Aussie was also fuelled after the IMF, in its latest review of Australia, expressed concerns on the economic growth of Australia and opined that the Australian Dollar needs to depreciate, in order to achieve a more sustainable growth.

Separately, another report showed that consumer inflation expectation in Australia remained unchanged at 2.3% in February, compared to the previous month.

The pair is expected to find support at 0.8884, and a fall through could take it to the next support level of 0.8833. The pair is expected to find its first resistance at 0.9027, and a rise through could take it to the next resistance level of 0.9119.

Market participants are expected to keep a close watch on RBA Deputy Governor, Guy Debelle’s speech, expected to commence later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.