On Friday, the AUD weakened 0.30% against the USD to close at 0.9398.

Data from Australia’s largest trading partner, China, showed that factory output in the nation rose 8.8% in May, in-line with market expectations, from a year earlier while retail sales rose more-than-expected 12.5%, the fastest pace of rise since December 2013. Separately, fixed-asset investment in the world’s second largest economy grew 17.2% in the first five months of 2014.

LME Copper prices declined 0.8% or $53.5/MT to $6671.5/MT. Aluminium prices fell 1.2% or $21.0/MT to $1801.0/MT.

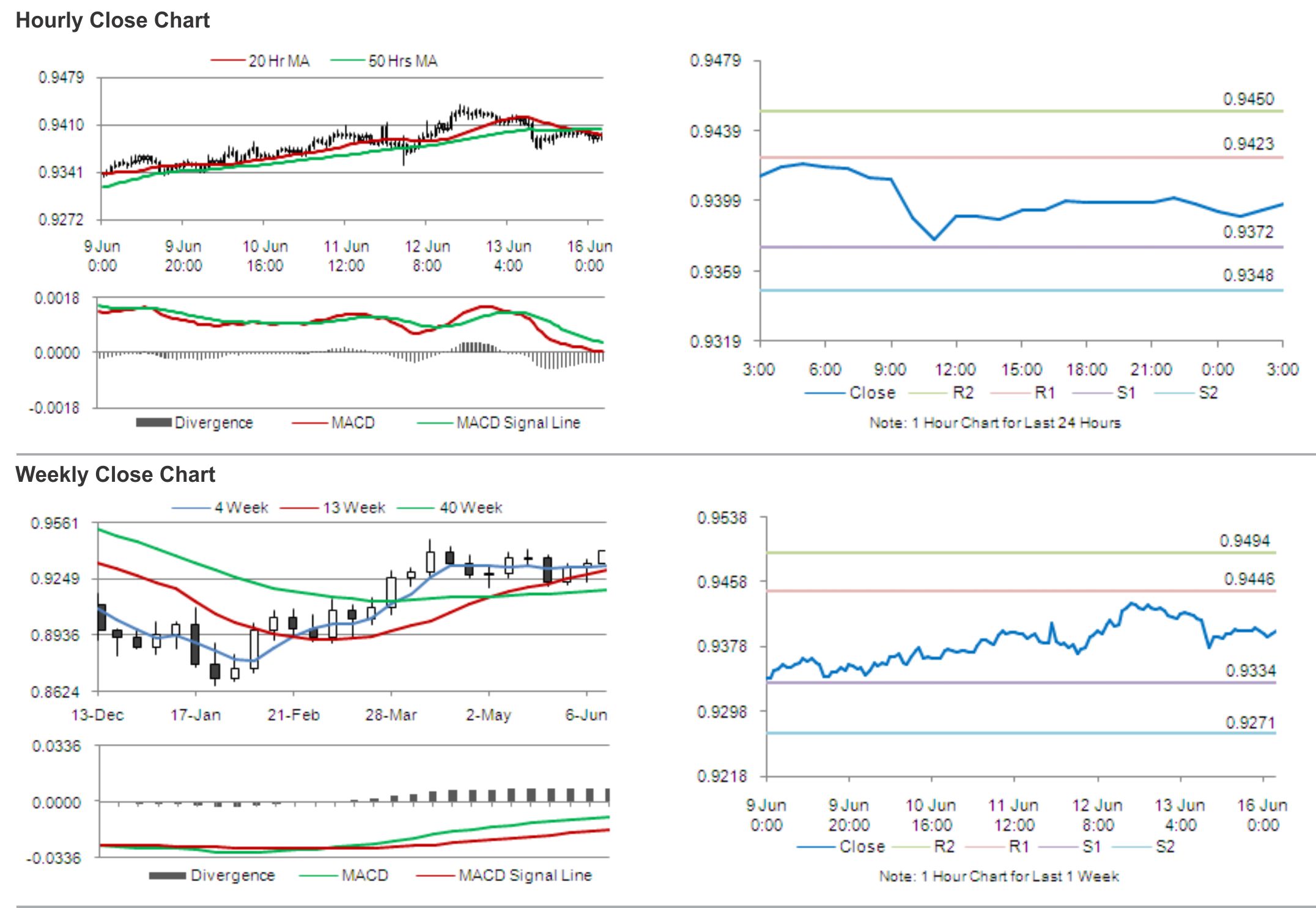

In the Asian session, at GMT0300, the pair is trading at 0.9397, with the AUD trading a tad lower from Friday’s close.

Earlier today, the RBA Assistant Governor, Christopher Kent, projected unemployment rate in Australia to remain elevated for the next two years while hinting that a weaker Australian Dollar would prove beneficial for economic growth in Australia. Furthermore, he added that, despite the recent depreciation in the value of Aussie over the past year, the currency remains high by historical standards, given the declined in commodity prices.

The pair is expected to find support at 0.9372, and a fall through could take it to the next support level of 0.9348. The pair is expected to find its first resistance at 0.9423, and a rise through could take it to the next resistance level of 0.9450.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.