For the 24 hours to 23:00 GMT, the AUD weakened 0.65% against the USD to close at 0.8964, on concerns that the economic growth prospects of China, its biggest trading partner is dwindling after the nation witnessed its first domestic bond default.

LME Copper prices edged up 0.1% or $4.5/MT to $6720.5/MT. Aluminium prices advanced 1.8% or $31.0/MT to $1746.0/MT.

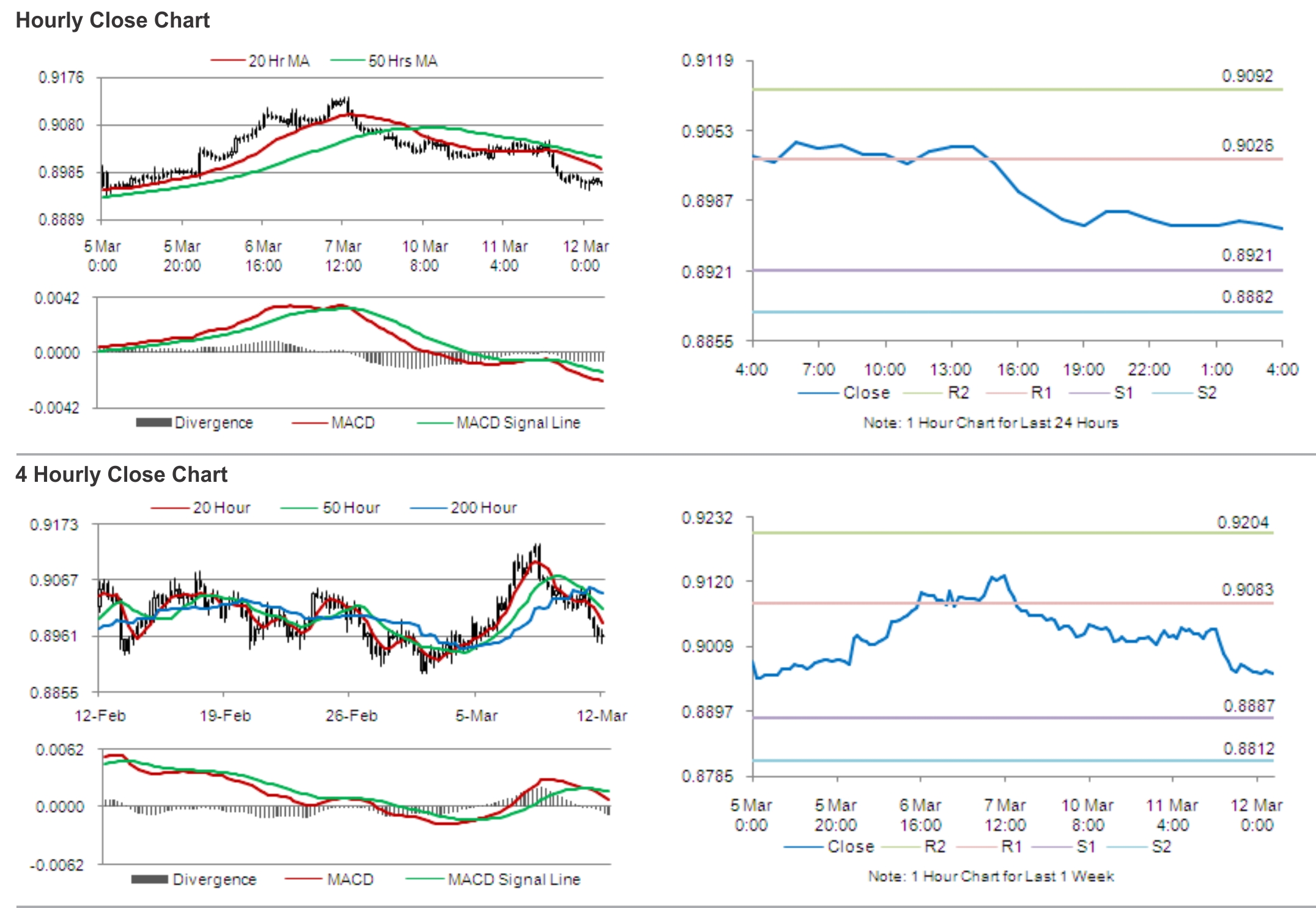

In the Asian session, at GMT0400, the pair is trading at 0.8961, with the AUD trading slightly lower from yesterday’s close, after data showed that the Westpac consumer confidence in Australia fell 0.7% to a 10-month low reading of 99.5 in March, from previous month’s level of 100.2. Separately, another report revealed that home loans in Australia registered a flat reading in January, contradicting analysts’ expectations for a 0.5% drop and compared to a 3.3% fall in December.

The pair is expected to find support at 0.8921, and a fall through could take it to the next support level of 0.8882. The pair is expected to find its first resistance at 0.9026, and a rise through could take it to the next resistance level of 0.9092.

With no major economic releasing during the later course of the day, market participants would await Australia’s employment and consumer inflation data, due for release on Thursday.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.