For the 24 hours to 23:00 GMT, the EUR declined 0.80% against the USD and closed at 1.1243.

The greenback gained ground after the second estimate of US annualized GDP rose 3.70% QoQ in 2Q 2015, more than market expectations for a rise of 3.20%. The preliminary figures had recorded a rise of 2.30%. The annualized GDP had climbed by a revised 0.60% in the prior quarter. The seasonally adjusted initial jobless claims in the nation dropped to 271.00 K in the week ended 22 August 2015, compared to a reading of 277.00 K in the prior week. Meanwhile, pending home sales rose less than expected by 0.50% MoM in July, compared to a revised drop of 1.70% in the previous month. The Kansas City Fed manufacturing activity index in the US unexpectedly fell to -9.00 in August, after recording a level of -7.00 in the previous month.

Meanwhile, Spanish final GDP grew 1.00% QoQ in 2Q 2015, in line with market expectations.

In the Asian session, at GMT0300, the pair is trading at 1.1262, with the EUR trading 0.17% higher from yesterday’s close.

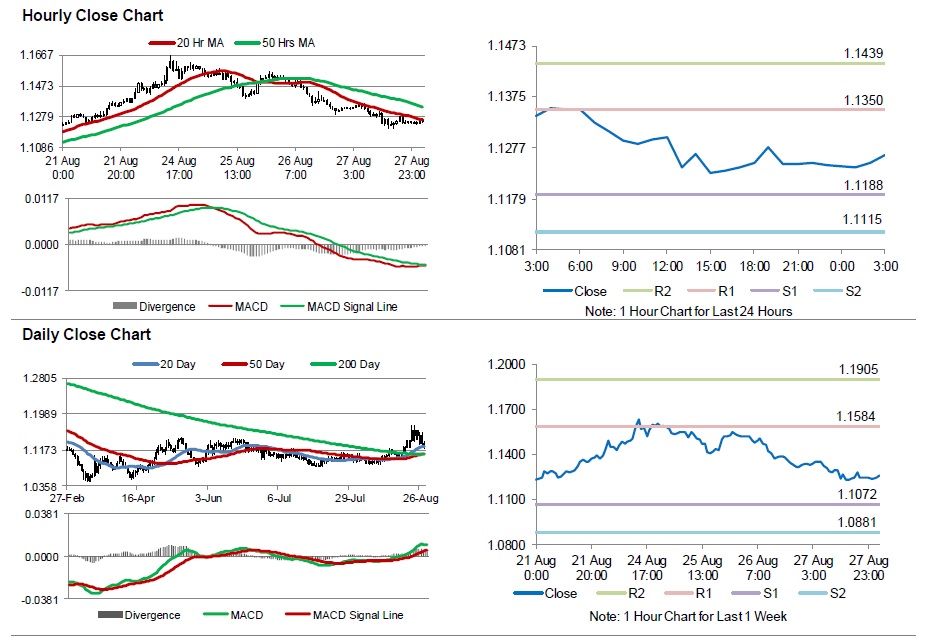

The pair is expected to find support at 1.1188, and a fall through could take it to the next support level of 1.1115. The pair is expected to find its first resistance at 1.135, and a rise through could take it to the next resistance level of 1.1439.

Trading trends in the Euro today are expected to be determined by a spate of economic releases from the euro region, due later in day. Additionally, personal spending and income for July as well as Michigan consumer sentiment index for August from the US would keenly awaited by the investors.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.