For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.0701 on Friday, amid concerns over the outcome of first round of voting in French presidential elections.

Earlier in the session, the Euro gained ground after robust manufacturing and services sector data in the Euro-zone highlighted a strong start to the second quarter, amid buoyant demand and strong growth in the region’s employment.

The Euro-zone’s flash Markit manufacturing PMI unexpectedly advanced to a level of 56.8 in April, expanding at its fastest pace since April 2011, compared to a level of 56.2 in the prior month. Markets were anticipating the PMI to drop to a level of 56.0. Moreover, the region’s preliminary Markit services PMI surprisingly rose to a six-year high level of 56.2 in April, defying market consensus for a fall to a level of 55.9 and following a reading of 56.0 in the previous month.

Other economic data indicated that the region’s seasonally adjusted current account surplus expanded to a level of €37.9 billion in February, following a revised surplus of €26.1 billion in the previous month.

Elsewhere, activity in Germany’s manufacturing sector slowed to a level of 58.2 in April, compared to a level of 58.3 in the prior month. Markets were anticipating the PMI to fall to a level of 58.0. Further, the nation’s services sector growth eased more-than-expected to a level of 54.7 in April, compared to market expectations of a fall to a level of 55.5. In the previous month, the PMI had registered a level of 55.6.

In the US, data indicated that the preliminary Markit manufacturing PMI unexpectedly eased to a seven-month low level of 52.8 in April, confounding market expectations of a rise to a level of 53.8, thus offering further sign that the world’s largest economy was losing momentum. The PMI had recorded a reading of 53.3 in the prior month. Also, the nation’s services PMI registered an unexpected drop to a level of 52.5 in April, hitting its lowest level in seven-months. The PMI had recorded a level of 52.8 in the previous month, while investors had envisaged for a rise to a level of 53.2.

On the other hand, the nation’s existing home sales rebounded more-than-anticipated by 4.4% on monthly basis in March, surging to its highest level in more than ten years. Markets expected existing home sales to gain 2.2%, after recording a revised drop of 3.9% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.0838, with the EUR trading 1.28% higher against the USD from Friday’s close, after the centrist candidate, Emmanuel Macron, won the first round of the French presidential election, reducing the risk of an anti-establishment shock in the final round.

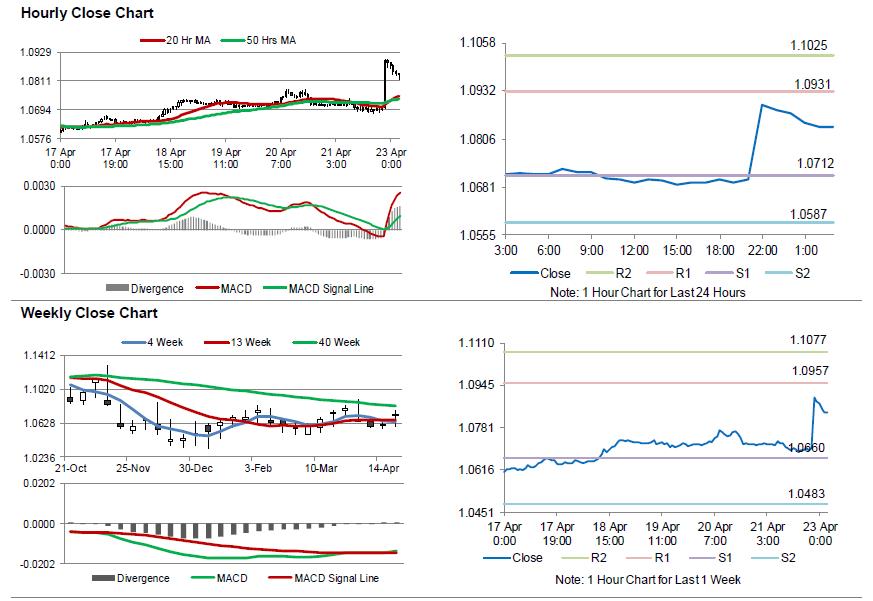

The pair is expected to find support at 1.0712, and a fall through could take it to the next support level of 1.0587. The pair is expected to find its first resistance at 1.0931, and a rise through could take it to the next resistance level of 1.1025.

Going ahead, investors will look forward to Germany’s Ifo expectations and business climate indices for April, slated to release in a few hours. Additionally, in the US, the Dallas Fed manufacturing activity index for April and the Chicago Fed national activity index for March, both scheduled to release later today, will be on investor’s radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.