For the 24 hours to 23:00 GMT, the EUR declined 0.32% against the USD and closed at 1.1057, after the European Central Bank’s (ECB) June meeting minutes revealed that policymakers were concerned about the Brexit vote.

According to the minutes of the ECB’s latest monetary policy meeting, Britain’s vote to leave the European Union could have significant negative repercussions on the Euro-zone, thus darkening the region’s growth outlook that is already facing headwinds. The policymakers warned that Brexit could dent the region’s growth through its impact on trade and financial markets.

In other economic news, Germany’s seasonally adjusted industrial production surprisingly fell the most in 21-months by 1.3% MoM in May, following a significant decline in capital goods output, thus showing that the nation’s industrial sector has lost steam after a strong start to the year. Meanwhile, markets expected it to remain flat, compared to a revised gain of 0.5% in the prior month.

The greenback gained ground after the latest set of US labour related reports confirmed that the nation’s job market remains on a solid footing despite tepid job gains in May.

Data showed that the number of people filing for initial jobless claims eased more-than-expected to 254.0K in the week ended 02 July 2016, touching its lowest level since mid-April. Markets anticipated it to fall to a level of 269.0K and after recording a revised level of 270.0K in the previous week. Additionally, the nation’s private sector employment rose more-than-expected by 172.0K in June, led by gains in small-business jobs. It had registered a revised gain of 168.0K in the previous month, while markets expected a rise of 160.0K.

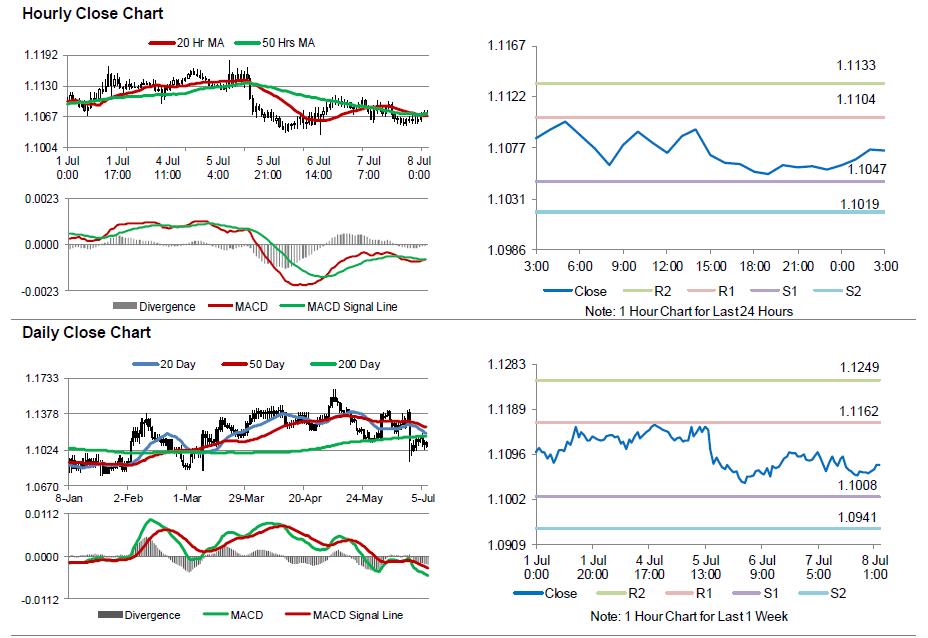

In the Asian session, at GMT0300, the pair is trading at 1.1074, with the EUR trading 0.15% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1047, and a fall through could take it to the next support level of 1.1019. The pair is expected to find its first resistance at 1.1104, and a rise through could take it to the next resistance level of 1.1133.

Going ahead, investors will look forward to Germany’s seasonally adjusted trade balance data for May, slated to release in a few hours. Additionally, the US unemployment rate and non-farm payrolls data, both for June, scheduled to be released later in the day, will garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.