For the 24 hours to 23:00 GMT, the EUR rose 0.27% against the USD and closed at 1.0636.

Yesterday, the European Central Bank (ECB) President, Mario Draghi, in his statement to the European Parliament, reiterated that the ECB needs to maintain its current level of monetary support to spur inflation in the region and bring it back to central bank’s target. Further, he added that the Euro-zone is recovering at a “moderate to steady pace and unemployment is falling”. Draghi also repeated his call that fiscal policies should also support the region’s economic recovery.

Meanwhile, according to the Bundesbank monthly report, German economy is expected to rebound in the fourth quarter, driven by strong industry, improved manufacturing outlook and robust consumer spending.

In the US, data indicated that the Chicago Fed national activity index improved to a level of -0.08 in October, suggesting that the nation’s economic growth is still lacking desired momentum. The index had recorded a revised reading of -0.23 in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.0629, with the EUR trading 0.07% lower against the USD from yesterday’s close.

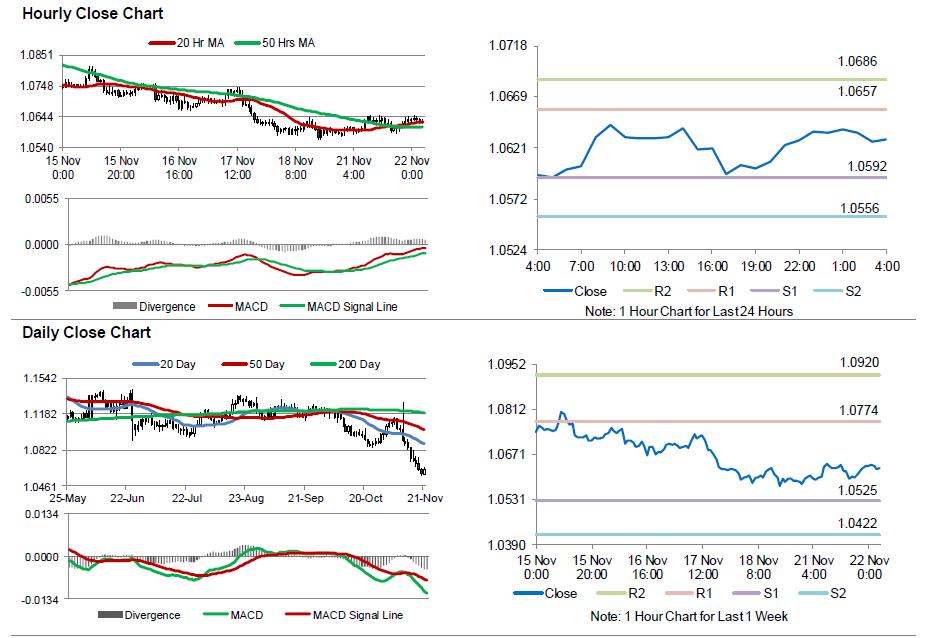

The pair is expected to find support at 1.0592, and a fall through could take it to the next support level of 1.0556. The pair is expected to find its first resistance at 1.0657, and a rise through could take it to the next resistance level of 1.0686.

Moving ahead, market participants await the release of Euro-zone’s consumer confidence index for November, due later today, which is expected to show a modest improvement. Additionally, the US existing home sales for October, slated to release later in the day, would attract a lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.