For the 24 hours to 23:00 GMT, the EUR remained flat against the USD and closed at 1.1215.

Yesterday, the European Central Bank (ECB) President, Mario Draghi, at a hearing at the Bundestag, shrugged off criticism that the central bank’s ultra-loose monetary policies had hindered the German economy while stating that these policies had averted the threat of a new ‘Great Depression’. Further, he added that the central bank’s monetary policy was a necessity to get the Euro-zone back on the growth track and to revive inflation in the region. He also warned that if the ECB’s decisions continue to be constantly attacked, the central bank might be forced to take more extensive measures to be effective.

In other economic news, data revealed that Germany’s GfK consumer confidence index unexpectedly dropped to a level of 10.0 in October, while markets expected the index to remain steady at a level of 10.2 in the prior month.

In the US, data indicated that flash durable goods orders surprisingly remained flat on a monthly basis in August, suggesting that the economy is struggling with sluggish business spending. In the prior month, durable goods orders recorded a revised rise of 3.6% whereas markets expected it to ease by 1.5%. Meanwhile, the nation’s mortgage applications fell by 0.7% in the week ended 23 September 2016, following a drop of 7.3% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1227, with the EUR trading 0.11% higher against the USD from yesterday’s close.

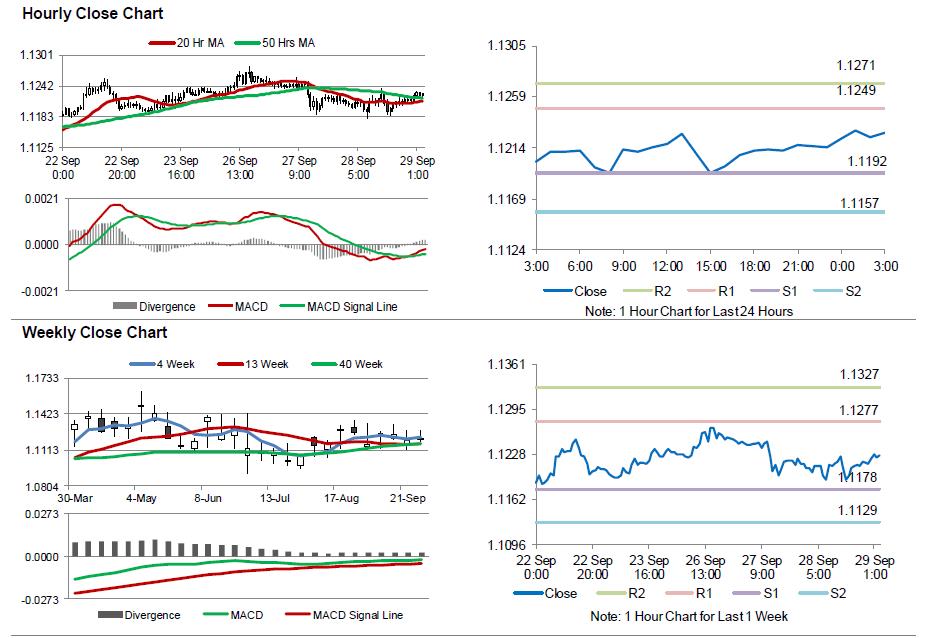

The pair is expected to find support at 1.1192, and a fall through could take it to the next support level of 1.1157. The pair is expected to find its first resistance at 1.1249, and a rise through could take it to the next resistance level of 1.1271.

This afternoon will bring two crucial data releases from Germany, namely the unemployment rate and consumer price index , both for September, due to release in a few hours. Additionally, the US annualised GDP for 2Q, initial jobless claims and pending home sales data for August, all scheduled to release later in the day, would pique investor attention.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.