For the 24 hours to 23:00 GMT, the EUR declined 0.12% against the USD and closed at 1.1596.

The European Central Bank (ECB) President, Mario Draghi, stated that most of the financial stability issues that were linked to low interest rates did not materialise and there is hardly any evidence that current negative interest rates in the Eurozone are hurting profitability of banks. Draghi also indicated that various reforms undertaken by European banks has strengthened the EU banking sector.

Macroeconomic data revealed that the Eurozone retail sales grew 0.7% on a monthly basis in September due to higher sales of clothing, food and tobacco, beating market expectations for a rise of 0.6%. In the previous month, retail sales had dropped by a revised 0.1%.

On the contrary, Germany’s industrial production declined 1.6% MoM in September, more than market expectations for a fall of 0.9%. In the last month, German industrial production had risen 2.6%. Moreover, the nation’s construction PMI dropped slightly to 53.3 in October from a reading of 53.4 in September.

In the US, JOLTs job openings unexpectedly rose to 6093.0K, topping market expectations of a fall to a level of 6075.0K, thereby indicating a resilient US job market. In the previous month, job openings had reported a revised reading of 6090.0K. Meanwhile, US consumer credit advanced $20.83 billion in September, compared to a revised increase of $13.14 billion in the prior month. Market anticipation was for consumer credit to rise $17.50 billion.

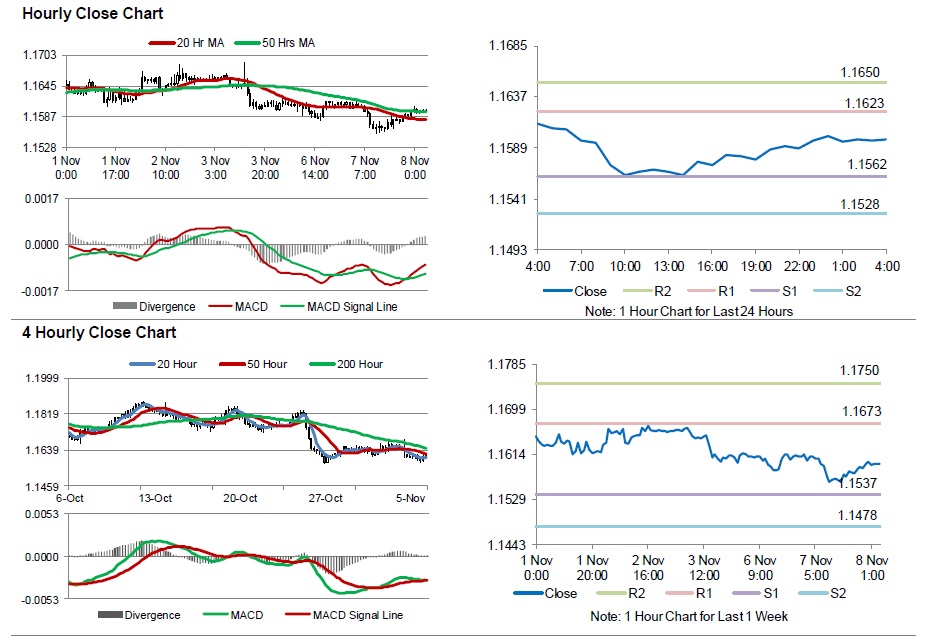

In the Asian session, at GMT0400, the pair is trading at 1.1597, with the EUR trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.1562, and a fall through could take it to the next support level of 1.1528. The pair is expected to find its first resistance at 1.1623, and a rise through could take it to the next resistance level of 1.165.

With no major economic data scheduled in the Eurozone today, investors would monitor the US mortgage applications for the week ended 03 November 2017 for further direction.

The currency pair is showing convergence with its 50 Hr moving average and trading above its 20 Hr moving average.