For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.1360, after the European Central Bank (ECB) slashed its growth forecasts for the euro area and confirmed that it would end its quantitative easing (QE) policy.

The ECB, in its latest monetary policy meeting, kept its benchmark interest rate unchanged at 0%. Officials expects the key interest rates to remain at their present levels at least through the summer of 2019. Further, the central bank confirmed that it will halt its four-year long massive stimulus programme in December. Meanwhile, the central bank cut its growth forecast for the euro area to 1.7% from 1.8% for 2018 and to 1.7% from 1.8% in 2019. Further, the inflation forecast for the next year was downgraded to 1.6% from 1.7% and for 2018 to 1.8% from 1.7%. In a post-meeting news conference, ECB President, Mario Draghi warned that Euro-zone’s growth outlook is likely to face downside risks due to ongoing geopolitical trade tensions.

On the macro front, Germany’s final consumer price index rose 2.3% on an annual basis in November, in line with market expectations and compared to a rise of 2.5% in the previous month. The preliminary figures had also indicated a rise of 2.30%.

In the US, the seasonally adjusted initial jobless claims dropped to 206.0K in the week ended 8 December, more than market expectations for a drop to a level of 226.0K. Initial jobless claims had registered a revised reading of 233.0K in the previous week. Meanwhile, budget deficit widened more-than-expected to $204.9 billion in November, compared to a deficit of $100.5 billion in the previous month.

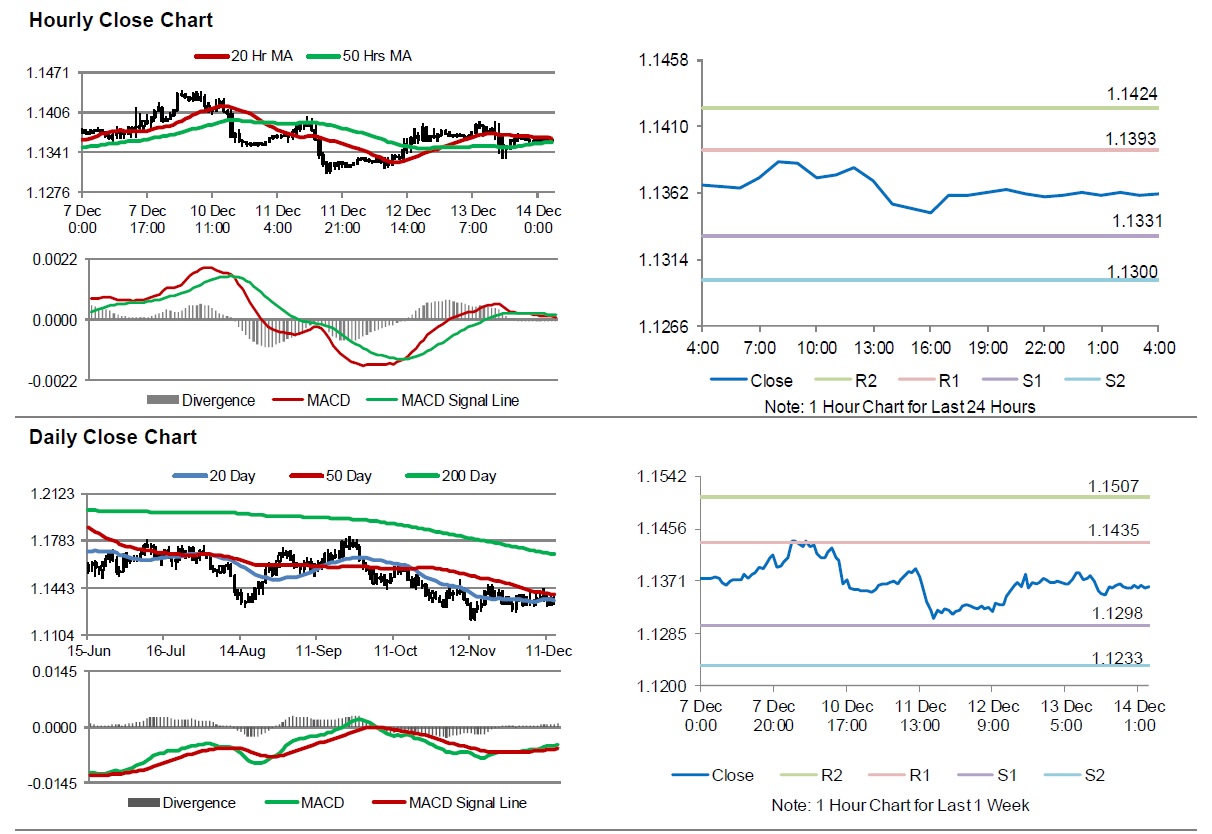

In the Asian session, at GMT0400, the pair is trading at 1.1362, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1331, and a fall through could take it to the next support level of 1.1300. The pair is expected to find its first resistance at 1.1393, and a rise through could take it to the next resistance level of 1.1424.

Moving ahead, investors would closely monitor the manufacturing and services PMIs, set to release across the euro area in a few hours. Later in the day, the US industrial production, manufacturing production and retail sales data, all for November, would pique significant amount of market attention. Additionally, the US manufacturing and services PMI for December along with business inventories for October, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.