For the 24 hours to 23:00 GMT, the EUR rose 1.65% against the USD and closed at 1.1181, after the European Central Bank’s (ECB) chief Mario Draghi hinted that the central bank would reduce interest rates again only in the most extreme of circumstances.

Yesterday, the ECB, in a surprise move, cut key interest rate to zero from 0.05% and expanded its asset-purchase program to €80.0 billion a month, from existing €60.0 billion and also slashed deposit rate to -0.40% from -0.30%, in a bid to boost inflation and reinvigorate growth in the faltering Euro-zone economy. Further, the ECB President, Mario Draghi, warned that rates would remain very low for at least another year and expected the Euro region to face lack of price pressures for months to come.

In other economic news, German trade surplus narrowed to €13.6 billion in January, from a revised trade surplus of €19.0 billion in the prior month. Markets were expecting the nation to register a trade surplus of €17.0 billion. Further, the nation’s exports unexpectedly fell by 0.5%, whereas imports rose more-than-anticipated by 1.2%, on a monthly basis in January.

In the US, initial jobless claims declined to a five-month low level of 259.0K in the week ended 05 March 2016, compared to market expectations of a fall to a level of 275.0K. Initial jobless claims had recorded a revised reading of 277.0K in the previous week. Further, the US swung to a budget deficit of $192.6 billion in February from a budget surplus of $55.2 billion reported in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1172, with the EUR trading 0.08% lower from yesterday’s close.

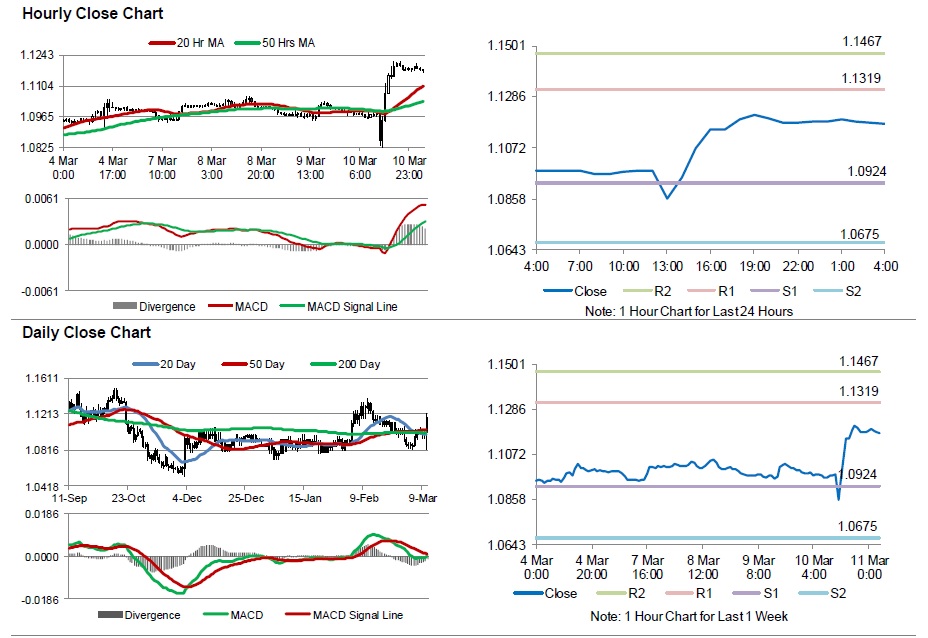

The pair is expected to find support at 1.0924, and a fall through could take it to the next support level of 1.0675. The pair is expected to find its first resistance at 1.1319, and a rise through could take it to the next resistance level of 1.1467.

Moving ahead, investors will look forward to Germany’s consumer price inflation data for February, scheduled to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.