For the 24 hours to 23:00 GMT, the EUR declined 1.52% against the USD and closed at 1.1636, after the European Central Bank (ECB), at its latest monetary policy meeting, unveiled plans to scale down but extend its quantitative easing programme.

The ECB, as widely expected, maintained the key interest rate unchanged at record low of 0.00%. Further, the central bank announced that it would halve its bond-buying programme from €60.0 billion a month to €30.0 billion a month starting from January 2018 and would continue until September 2018, or beyond, if necessary. In a post meeting statement, the ECB President, Mario Draghi, expressed optimism over the Euro-bloc’s recovery but confirmed that ultra-loose monetary policy would remain for the foreseeable future to bring inflation to the central bank’s target in a sustainable way.

On the data front, Germany’s GfK consumer confidence index unexpectedly dropped to a level of 10.7 in November, confounding market expectations for the index to remain steady at a level of 10.8 recorded in the prior month.

In the US, data revealed that first time claims for the US unemployment benefits rose less-than-expected to a level of 233.0K in the week ended 21 October, after hitting a revised 44-year low level of 223.0K in the prior week, while markets had expected for a rise to a level of 235.0K. Further, the nation’s advance goods trade deficit expanded to a four-month high of $64.1 billion in September, as imports rose for the first time since April. Market participants had envisaged the nation to register an advance goods trade deficit of $64.0 billion, after registering a revised deficit of $63.3 billion in the previous month.

Other data indicated that the US pending home sales remained flat on a monthly basis in September, compared to a revised fall of 2.8% in the previous month, highlighting that housing sector has faltered this year. Market anticipation was for pending home sales to climb 0.5%. Also, the nation’s preliminary wholesale inventories registered a less-than-expected rise of 0.3% in September. In the previous month, wholesale inventories had risen 0.9%.

In the Asian session, at GMT0300, the pair is trading at 1.1635, with the EUR trading slightly lower against the USD from yesterday’s close.

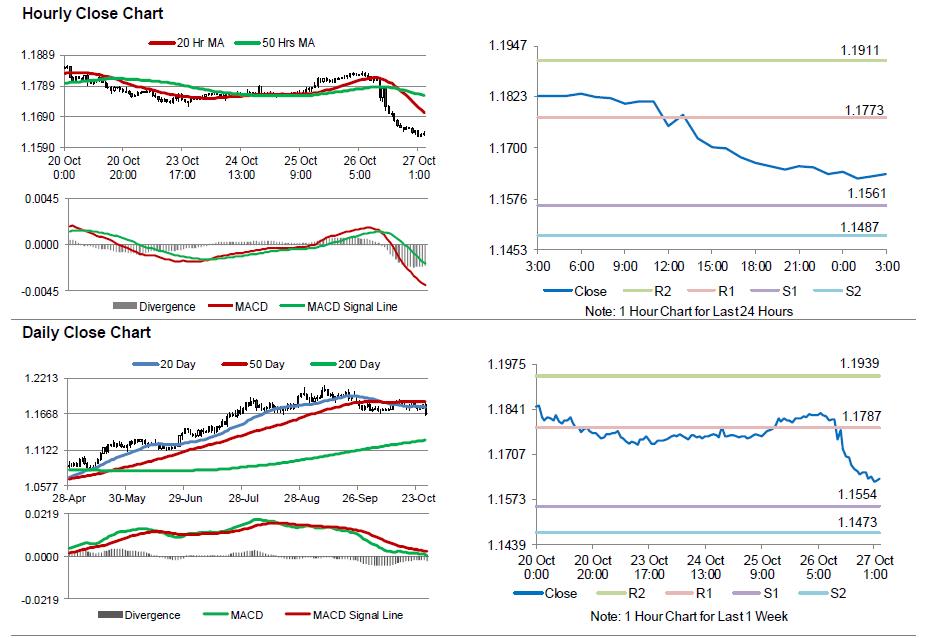

The pair is expected to find support at 1.1561, and a fall through could take it to the next support level of 1.1487. The pair is expected to find its first resistance at 1.1773, and a rise through could take it to the next resistance level of 1.1911.

With no major macroeconomic releases in the Euro-zone today, traders would direct their attention to the US flash 3Q GDP numbers and the final Michigan consumer confidence index for October, due to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.