For the 24 hours to 23:00 GMT, the EUR declined 0.91% against the USD and closed at 1.1121, on the back of dovish comments made by the ECB Chief, yesterday.

The ECB Chief, Mario Draghi at a press conference revealed a revamp of €1.1 trillion asset-buying program and signalled that the central bank members might expand stimulus if the downfall in global financial markets and decline in commodity markets continues to prompt weaker growth and inflation forecasts. Additionally, the ECB in its recent policy meeting kept interest rates unchanged and downgraded inflation and growth forecasts indicating worries from recent development in Chinese economy.

In other economic news, the seasonally adjusted retail sales advanced 0.40% in the Eurozone, compared to a revised drop of 0.20% in the previous month. Markets were anticipating retail sales to climb 0.50%. Meanwhile, the German final services PMI recorded an unexpected rise to 54.90 in August, compared to a reading of 53.80 in the previous month, while the final services PMI in the Eurozone recorded a rise to 54.40 in August, compared to a reading of 54.00 in the prior month. Market were expecting it to advance to a level of 54.30.

In the US, the non-manufacturing PMI eased to 59.00 in August, in the US, compared to market expectations of a fall to 58.20. The non-manufacturing PMI had recorded a reading of 60.30 in the prior month.

Other economic data revealed that the seasonally adjusted initial jobless claims in the US rose to a level of 282.00 K, compared to market expectations of an advance to a level of 275.00 K and following a revised reading of 270.00 K in the prior week.

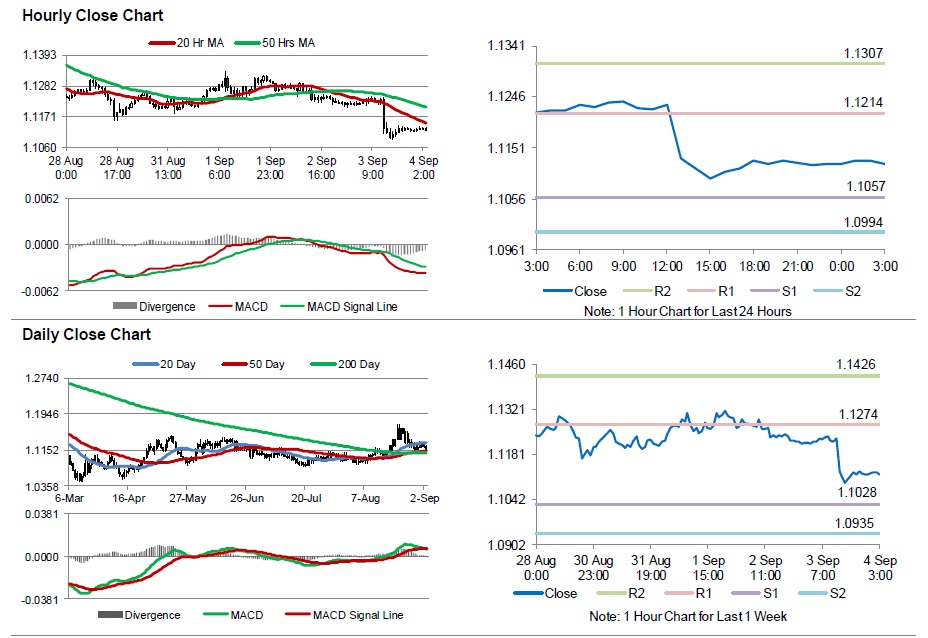

In the Asian session, at GMT0300, the pair is trading at 1.1121, with the EUR trading flat from yesterday’s close. Meanwhile, the nation’s trade deficit narrowed more than expected to $41.86 billion, following a revised deficit of $45.21 billion in the prior month. The pair is expected to find support at 1.1057, and a fall through could take it to the next support level of 1.0994. The pair is expected to find its first resistance at 1.1214, and a rise through could take it to the next resistance level of 1.1307.

Trading trends in the Euro today are expected to be determined by Germany’s factory orders data, scheduled in a few hours. Additionally, the US crucial non-farm payrolls and unemployment data, scheduled later today would grab lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.