For the 24 hours to 23:00 GMT, the EUR rose 0.44% against the USD and closed at 1.1278, after the European Central Bank (ECB) postponed its interest rate hike deadline.

The ECB, in its June monetary policy meeting, opted to leave its benchmark interest rate unchanged at 0.00%, as widely expected and delayed its first post-crisis interest rate hike until at least the middle of 2020, citing the impact of escalating trade tensions. However, the central bank raised its growth and inflation outlook for this year but slashed the same for 2020. Growth forecast for this year was raised to 1.2% from 1.1% and inflation projection for 2019 was raised to 1.3% from 1.2%. However, the growth outlook for next year was reduced to 1.4% from 1.6% and the forecast for 2021 was cut to 1.4% from 1.5%.

On the macro front, Euro-zone’s seasonally adjusted final gross domestic product (GDP) climbed 0.4% on a quarterly basis in 1Q19, meeting market forecast and compared to a rise of 0.2% in the previous quarter. The preliminary figures had also indicated an advance of 0.4%.

Separately, in Germany, seasonally adjusted factory orders unexpectedly rose 0.3% on a monthly basis in April, defying market expectations for a steady reading. In the prior month, factory orders had recorded a revised gain of 0.8%. Meanwhile, the nation’s construction PMI declined to a level of 51.4 in May, following a reading of 53.0 in the prior month.

In the US, data showed that trade deficit narrowed to $50.8 billion in April, amid decline in both import and exports and following a revised trade deficit of $51.9 billion in the previous month. Market participants had expected the nation to register a deficit of $50.7 billion. Meanwhile, the number of Americans filing for fresh unemployment benefits remained steady at a level of 218.0K, defying market anticipations for a drop to a level of 215.0K.

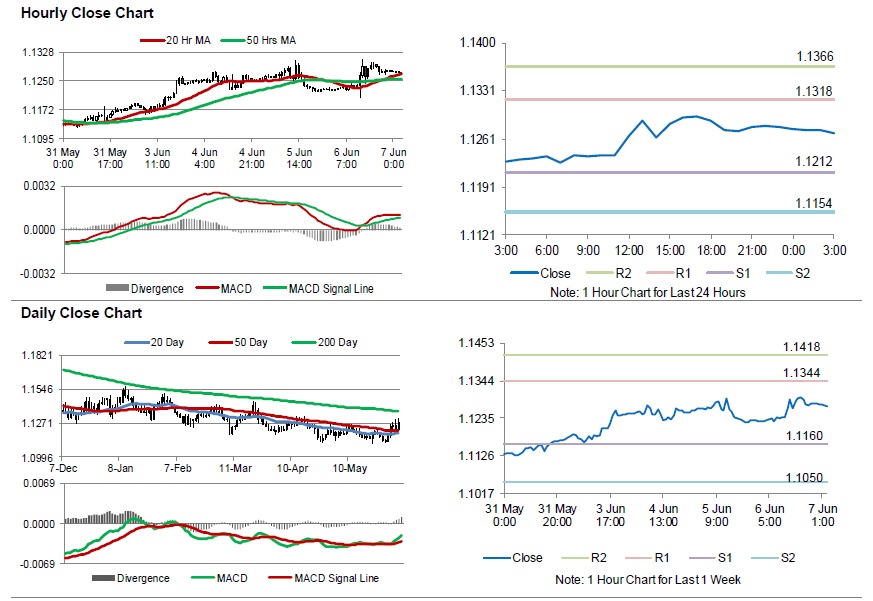

In the Asian session, at GMT0300, the pair is trading at 1.1269, with the EUR trading 0.08% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1212, and a fall through could take it to the next support level of 1.1154. The pair is expected to find its first resistance at 1.1318, and a rise through could take it to the next resistance level of 1.1366.

Going forward, traders would await Germany’s industrial production and trade balance, both for April, set to release in a few hours. Later in the day, the US non-farm payrolls, unemployment rate and average hourly earnings, all for May, will garner significant amount of investor’s attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.

https://www.telegraph.co.uk/business/2019/06/06/markets-latest-news-pound-euro-ftse-100-markets-rally-slows/

https://www.telegraph.co.uk/business/2019/06/06/markets-latest-news-pound-euro-ftse-100-markets-rally-slows/

https://www.reuters.com/article/us-usa-economy-trade/us-trade-deficit-shrinks-on-weak-imports-exports-idUSKCN1T71LA