For the 24 hours to 23:00 GMT, the EUR declined 0.46% against the USD and closed at 1.0926.

Yesterday, the European Central Bank (ECB), in its latest monetary policy meeting, kept the key interest rate unchanged at 0.00%, in line with market expectations, but left the door open to inject more stimulus in December. Further, the central bank reaffirmed that it intends to continue plans to maintain its quantitative easing programme at €80.0 billion until the end of March 2017 or beyond, if needed. Meanwhile, policymakers reiterated that they expect the benchmark interest rates to remain at present or lower levels for an extended period of time.

In a post meeting speech, the ECB President, Mario Draghi, indicated that the ECB would wait until December to discuss tapering its asset purchase program, or the possible horizon at which stimulus might end.

In other economic news, the Euro-zone’s seasonally adjusted current account surplus expanded to a level of €29.7 billion in August, following a revised current account surplus of €27.7 billion in the previous month.

Elsewhere, in Germany, the producer price index unexpectedly dropped by 0.2% MoM in September, compared to a fall of 0.1% in the prior month and confounding market expectation for the index to rise by 0.2%.

Macroeconomic data released in the US showed that initial jobless claims advanced more-than-expected to a level of 260.0K in the last week, compared to a revised level of 247.0K in the previous week whereas markets had envisaged initial jobless claims to advance to a level of 250.0K. On the other hand, the nation’s Philadelphia Fed manufacturing index rose more-than-expected to a level of 9.7 in October, compared to market expectations for it to rise to a level of 5.0 and following a reading of 12.8 in the prior month. Also, the nation’s existing home sales rebounded more-than-anticipated by 3.2% MoM in September, hitting its highest level since June. Markets anticipated for a gain of 0.4%, after recording a revised fall of 1.5% in the previous month. Further, the nation’s leading indicator rebounded by 0.2% on a monthly basis in September, at par with market expectations and compared to a drop of 0.2% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.0898, with the EUR trading 0.26% lower against the USD from yesterday’s close.

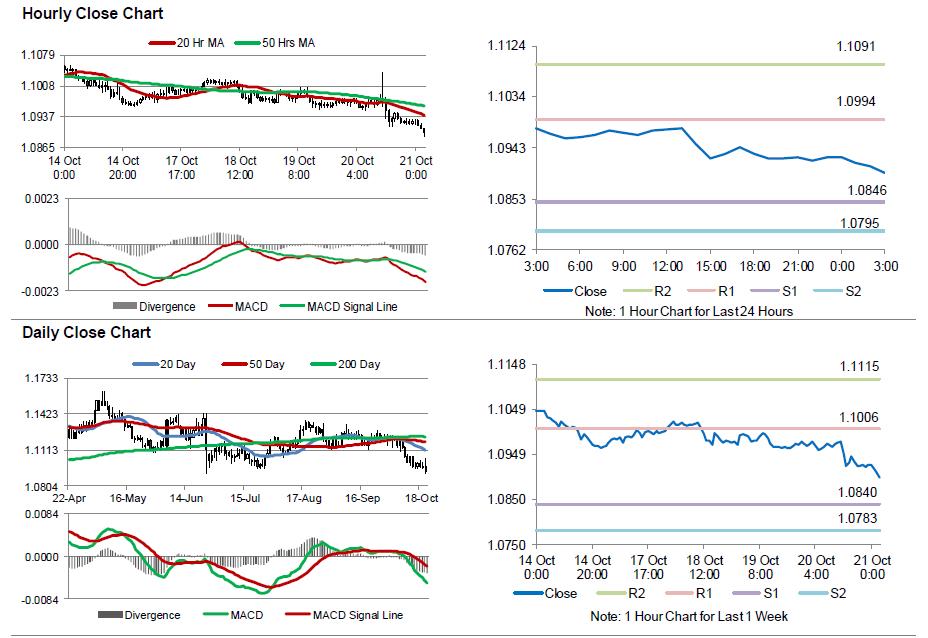

The pair is expected to find support at 1.0846, and a fall through could take it to the next support level of 1.0795. The pair is expected to find its first resistance at 1.0994, and a rise through could take it to the next resistance level of 1.1091.

Moving ahead, market participants would look forward to the Euro-zone’s flash consumer confidence index for October, scheduled to release later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.