For the 24 hours to 23:00 GMT, the EUR declined 0.36% against the USD and closed at 1.0868, after the European Central Bank (ECB) President, Mario Draghi, gave no hints to curtail its massive bond-buying programme in the coming months.

The ECB, at its latest monetary policy meeting, maintained the key interest rate at 0.00% and left its monetary stimulus programme unchanged. In a post-meeting statement, the ECB President, Mario Draghi, reiterated that the central bank could increase the size or duration of its asset-buying programme if inflation looks set to fall far back below its target of near 2.0%. Nevertheless, Draghi expressed optimism over the Euro-zone’s economic recovery, noting that it was increasingly solid, but stated that inflation pressures in the region remain subdued and are yet to show a convincing upward trend.

On the macro front, the economic sentiment indicator in the common currency region surged to a ten-year high level of 109.6 in April, amid increased optimism over the health of the region’s economy. The index had registered a revised reading of 108.0 in the previous month. Additionally, the region’s final consumer confidence index was confirmed at -3.6 in April, compared to a reading of -5.0 in the prior month.

Elsewhere, in Germany, the preliminary consumer price index advanced more-than-anticipated by 2.0% YoY in April, highlighting that inflation in the Euro-zone’s largest economy is picking up, as an economic upswing continues and the labour market strengthens. Market participants had envisaged for a rise of 1.9%, following a gain of 1.6% in the previous month.

Macroeconomic data released in the US indicated that advance goods trade deficit widened less-than-anticipated to a level of $64.8 billion in March, from a revised deficit of $63.9 billion in the prior month. Also, the nation’s initial jobless claims advanced to a level of 257.0K last week, topping market expectations of a rise to a level of 245.0K. In the prior week, initial jobless claims had recorded a revised level of 243.0K. Moreover, the nation’s pending home sales eased 0.8% in March, less than market expectations for a fall of 1.0%. In the prior month, pending home sales had registered a rise of 5.5%. Further, the nation’s seasonally adjusted flash wholesale inventories registered an unexpected drop of 0.1% in March, defying investor consensus for an advance of 0.2% and following a rise of 0.4% in the previous month.

Another economic data revealed that the US flash durable goods orders rose less-than-expected by 0.7% in March, growing at its slowest pace since December 2016. Markets expected durable goods orders to rise 1.3%, after recording a gain of 1.8% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.0866, with the EUR trading slightly lower against the USD from yesterday’s close.

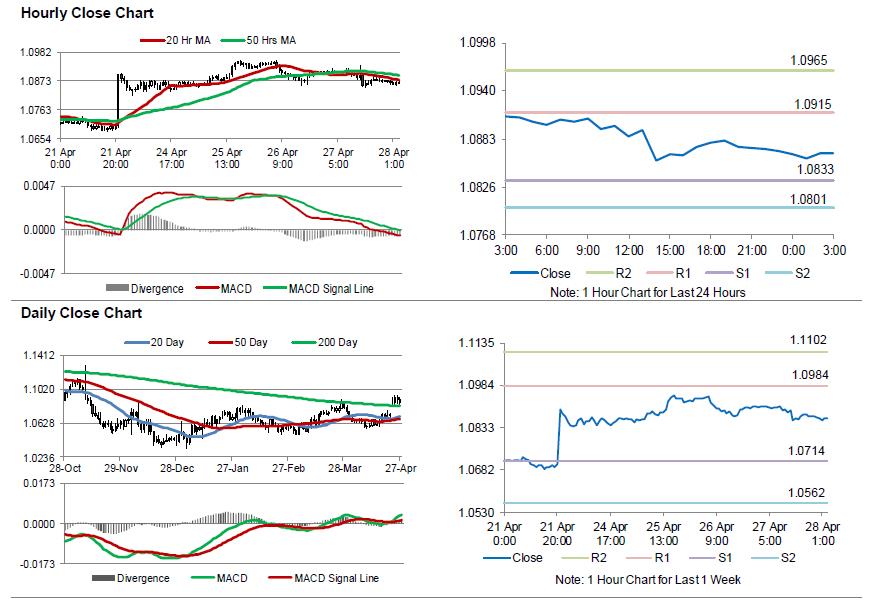

The pair is expected to find support at 1.0833, and a fall through could take it to the next support level of 1.0801. The pair is expected to find its first resistance at 1.0915, and a rise through could take it to the next resistance level of 1.0965.

Ahead in the day, investors will look forward to the Euro-zone’s flash inflation figures for April and Germany’s retail sales for March. Moreover, in the US, flash annualised GDP for Q1 and final Michigan consumer sentiment index for April, both slated to release later in the day, will garner a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.