For the 24 hours to 23:00 GMT, the EUR declined 0.5% against the USD and closed at 1.1145, after minutes of the European Central Bank’s (ECB) recent monetary policy meeting indicated that financing conditions in the Euro-zone would remain accommodative to underpin economic recovery.

Minutes indicated that policymakers widely agreed the Euro-zone’s economy needs continued monetary stimulus as it is still not showing convincing signs of a sustained pickup in inflation. Further, it indicated that the central bank is committed to maintaining its massive bond-buying program until the end of March 2017 while the policymakers showed their willingness to act to bring inflation back to their target by using all instruments within its mandate and “without undue delay” to achieve the objective of price stability.

In other economic news, data revealed that Germany’s seasonally adjusted factory orders rose more-than-expected by 1.0% MoM in August, rising at the fastest pace in five-months, thus suggesting that factories would remain a driving factor in Euro-zone’s economic powerhouse in the near-term. Meanwhile, markets expected it to rise by 0.3%, following a revised rise of 0.3% in the previous month. Additionally, the nation’s construction PMI advanced to a level of 52.4 in September, notching its highest level in 4 months, after recording a level of 51.6 in the previous month.

Macroeconomic data released in the US indicated that the number of Americans filing for fresh unemployment benefits unexpectedly dropped to a level of 249.0K in the last week, hitting its lowest level in nearly 43-years, thus strengthening the case of a US Fed interest rate hike by the year end. Initial jobless claims recorded a level of 254.0K in the previous week whereas markets anticipated it to advance to a level of 256.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1124, with the EUR trading 0.19% lower against the USD from yesterday’s close.

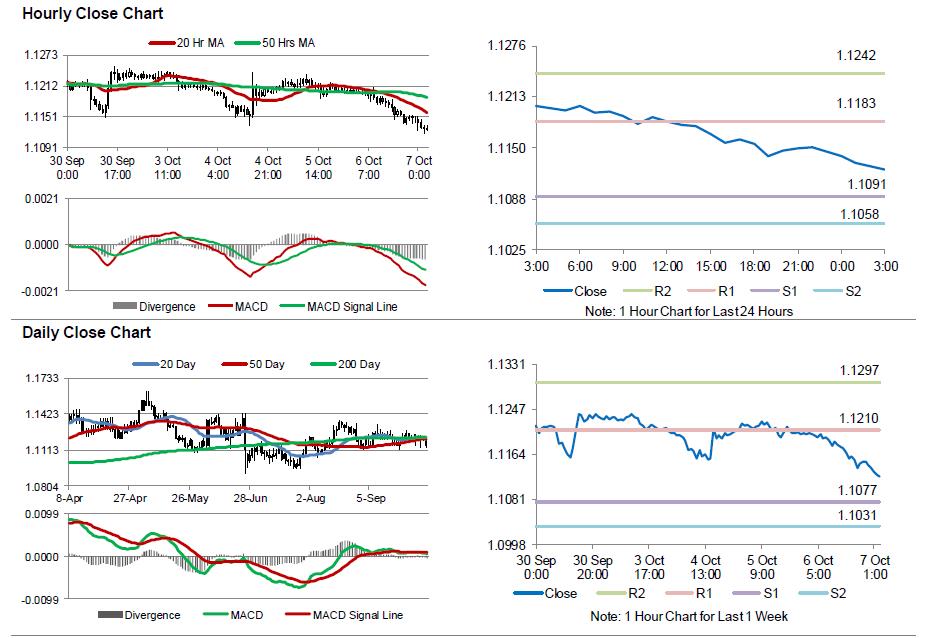

The pair is expected to find support at 1.1091, and a fall through could take it to the next support level of 1.1058. The pair is expected to find its first resistance at 1.1183, and a rise through could take it to the next resistance level of 1.1242.

Moving ahead, investors would concentrate on Germany’s industrial production for August, slated to release in a few hours. Moreover, this evening would bring two crucial data releases in the US, namely the unemployment rate and change in non-farm payrolls, both for September.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.