For the 24 hours to 23:00 GMT, the EUR declined 0.30% against the USD and closed at 1.3527. Remarks from the Fed Chief, Janet Yellen, continued to support the greenback. In her testimony, Yellen convinced lawmakers that the world’s largest economy, US would starting raising its interest rates earlier and faster than expected, once the nation’s inflation and employment improve.

The US Dollar was boosted after data released indicated that the manufacturing output in the US advanced at its fastest pace in more than two years in the second quarter, suggesting that the economy is on track. The factory production rose 6.7%, on an annual basis, the fastest since the first quarter of 2012. Additionally, the producer inflation advanced 0.4%, on a monthly basis in June, reversing its earlier month’s 0.2% decline. Another data indicated that the US Department of Treasury posted a net treasury international capital (TIC) long term inflow of $19.4 billion in the US in May, compared to a revised outflow of $41.2 billion in the previous month. Further, the housing market index in the US jumped to a six-month high level of 53.0 in July, compared to a level of 49.0 in the previous month.

Yesterday, the Fed’s Beige Book survey revealed that the economy grew in all regions of the US in June and early July, buoyed by rise in consumer spending. Meanwhile, Dallas Fed President, Richard Fisher, citing rising signs of financial market excess and continued economic growth, noted that the central bank should hike its rates by early next year “or potentially sooner.”

The Euro came under pressure, after the trade surplus from the common currency bloc widened less than expected to €15.3 billion in May, as compared to market expectations of a trade surplus of € 16.0 billion.

The ECB Governing Council Member, Ewald Nowotny doubted the central bank’s intention to purchase asset-backed securities in order to boost growth in the region.

In the Asian session, at GMT0300, the pair is trading at 1.3529, with the EUR trading tad higher from yesterday’s close.

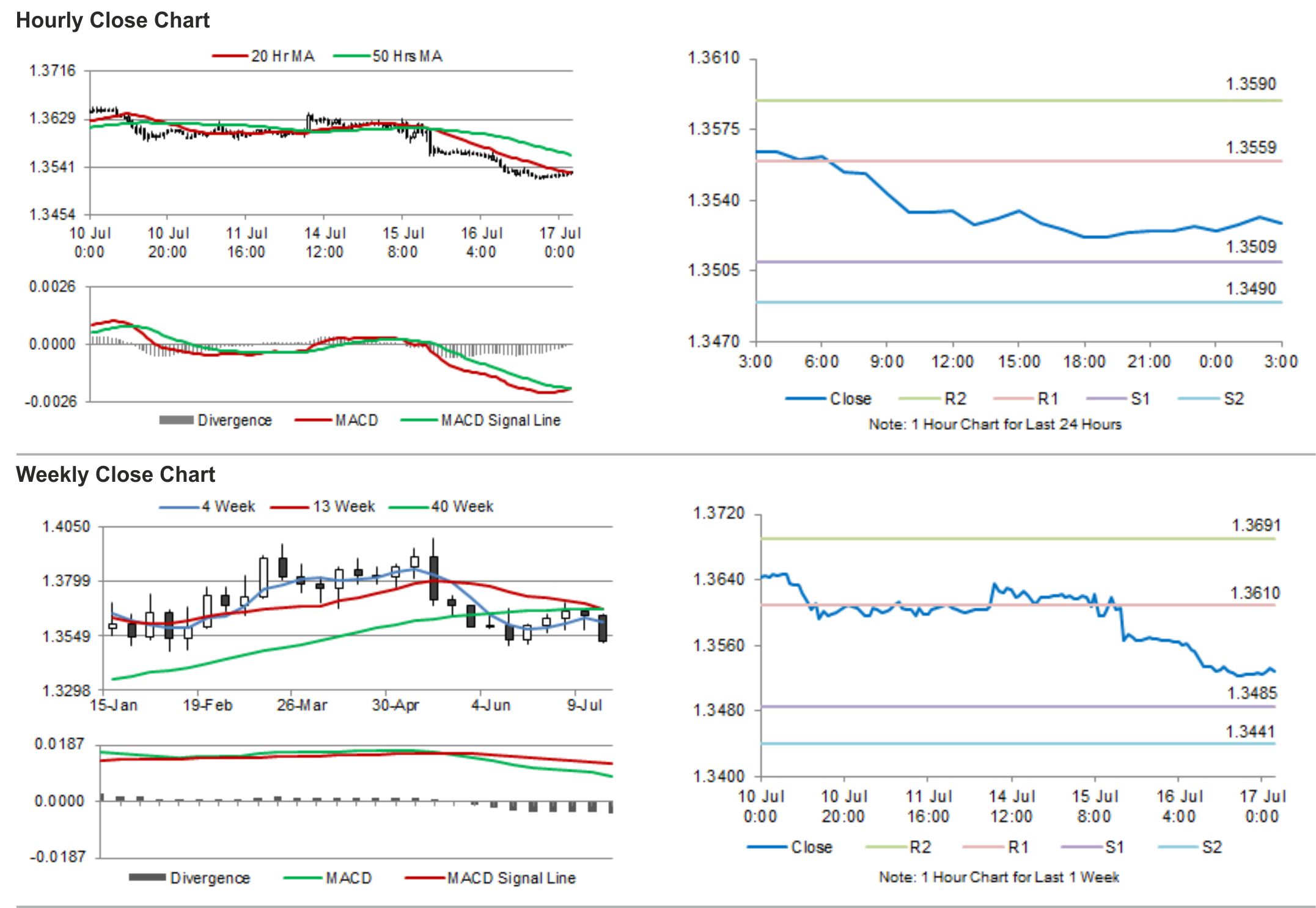

The pair is expected to find support at 1.3509, and a fall through could take it to the next support level of 1.3490. The pair is expected to find its first resistance at 1.3559, and a rise through could take it to the next resistance level of 1.3590.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.